Alibaba is rapidly expanding its new offline retail food store chain, Freshippo or Hema in Chinese, with stores operating on cutting-edge innovations

Imagine a top-flight supermarket, bathed in glowing white light and filled with the best food products the world can provide. The store doubles as a distribution center, so conveyor belts whiz overhead carrying a steady stream of blue shopping bags to motorbikes that deliver fresh produce to customers at home within 30 minutes of them having placed their orders online. This is not a flight of fancy but describes Freshippo in China. For many people, it represents the future of food retail.

At first glance, the Freshippo stores look like any other upscale supermarket, but tech integration is taken to another level with digital price tags, self-checkout, mechanized and robot transport of products from store to delivery drivers, and to instore food courts. Shoppers scan barcodes to get personalized recipe suggestions and information of everything is available through the store’s mobile app, with the ubiquitous Alipay used for mobile payment.

It’s a futuristic experience, and the store chain, known in Chinese as Hema, is growing rapidly. It is part of the tech giant Alibaba group and it is at the forefront of re-making the concept of how to combine online and offline retail of fresh foods, online ordering and grocery delivery services. Hema says it keeps prices down by directly sourcing products, including top quality foods from overseas. To appeal to single shoppers—a target group—package sizes are small, and all produce in the stores have a one-day turnover, ensuring freshness.

China has suffered several food safety scares in the past few years, and Hema’s transparency, offering a clear traceability of products via its app, gives customers an extra level of confidence. The app also helps to build a community among shoppers, with users being able to see the most popular items of the day and view feedback from other shoppers on different products.

“I think Hema is great!” said Andrea Liu, a millennial living in Shanghai. “Deliveries often arrive in under 20 minutes and it’s a relief to not have to carry all my shopping home myself. The times that I have gone into Hema stores have always been quick and convenient.”

“Hema has a ‘halo effect’ for a few reasons,” says Michael Norris strategy and research manager at AgencyChina, a market intelligence firm. “It’s the first supermarket to be run by a technology giant, and it was also the first supermarket in China to fully integrate online and offline ordering.” Such integration is vital in China, where consumers are increasingly using their phones for every conceivable purchase.

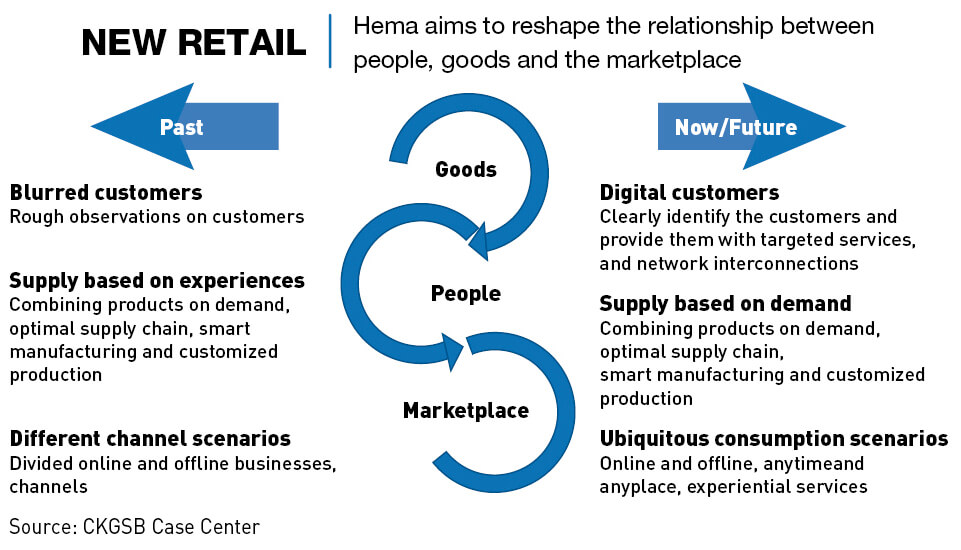

Hema epitomizes the concept Alibaba founder Jack Ma dubs “new retail,” which sees the full integration of online and offline shopping using technology, data and customer engagement. While online shopping has been huge in China for several years, fresh food was not on the menu until recently.

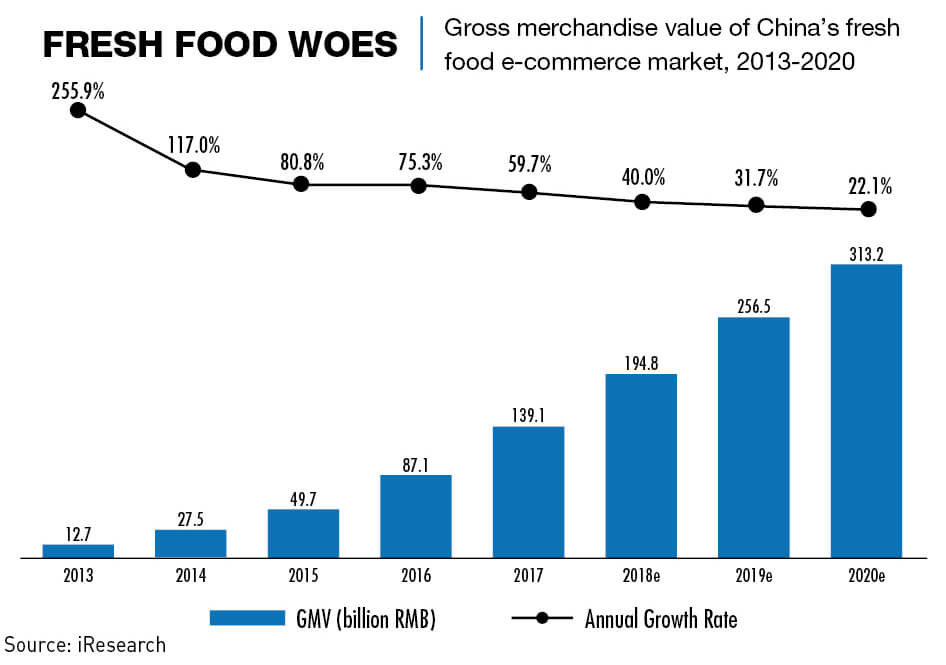

“The online channel only accounted for about 4% of overall fresh food distribution in China, and the vast majority of fresh food sales still occurred offline,” says Professor Bing Jing of CKGSB, referring to 2019 data. Furthermore, retail space turnover in China tends to be high. Shanghai shopper David Zhang notes that the space occupied by his local Freshippo/Hema supermarket has played host to at least two other stores in the last five years, including a Walmart.

Wading in

The first Hema store opened in Shanghai in 2016 and operates mainly in China’s tier-one and -two mega cities. “Hema already has 228 regular stores,” says Jing. “This size allows it to procure many products from the source rather than from a wholesaler. For example, it directly imports salmon, cherries and kiwis from Norway, Chile and New Zealand, respectively.”

The main competition comes from China’s other tech heavy hitters, Tencent and JD.com. “JD.com follows a retail strategy similar to Alibaba’s New Retail: it is called Unbounded Retail,” says Steffi Noel, project leader at Daxue Consulting. “It is based on the same pillars as Hema. JD.com has opened stores called 7Fresh which only sells food products, 75% of which is fresh.” Tencent, meanwhile, is working with the Carrefour hypermarkets, which are now majority-owned by China’s Sun Art supermarket chain.

But competition also comes from a myriad smaller shops and individuals selling fresh food locally, both online and offline. “There are some other online venders around my home that provide daily vegetables, like Carrefour, Dingdong Maicai and Yonghui,” says Hema consumer Zhang. Jing notes that the more traditional competitors are often cheaper than Hema, but delivery can take longer.

Hema’s profitability is difficult to judge as Alibaba treats the figures as classified and combines the company’s accounts with other units. “Based on Alibaba’s data, offering a combination of online and offline shopping options results in an increase in average monthly spending by customers,” says Steven Gutteridge, Head of Technology for Greater China at AKQA, a digital marketing agency. “Consumers who shopped both online and offline at Hema spent an average of RMB 575 ($82) monthly, compared to under RMB 300 for purely online, or purely offline shoppers.”

This, though, is likely due to the target consumer base of Hema, which positions itself as a relatively upmarket brand and has a product mix emphasizing relatively expensive seafood and imported goods.

“On a revenue-per-square-meter basis, Hema reaches three to five times the revenue of its competitors,” says Norris. But it takes around 18 months for a Hema store to achieve that level and it only applies to outlets in tier-one cities.

Hema has grown rapidly. From August 2019 to the end of the year, the number of stores in operation jumped from 171 to 197. Noel says Alibaba plans to have at least 2,000 Hema stores across China by 2022. Direct competitor 7Fresh, however, also aims to open 1,000 stores over the next three years.

Anatomy

Key to the Hema experience is its mobile app, which is far more than just a way of ordering and paying for food online. “Hema is a perfect blend of offline and online experience,” says Noel. “To get more information about a product, you can scan the QR code on the product and on your smartphone you have access to videos, infographics and info about the origin, the farmer, the history of the product and even ideas for cooking it.”

Many traditional supermarkets in developed markets have tacked the online element onto their existing offering, but Hema integrated all channels right from the start. Visually, this is evidenced by how much a Hema store differs from a traditional supermarket. “Hema pioneered the ‘store-as-a-warehouse’ retail model in China,” says Jing. “The distinguishing feature is that its stores are remodeled as warehouses to expedite fulfilment of online orders.”

With deliveries promised in such a short time, orders are simultaneously filled in different parts of the store with the conveyor system taking the goods for collation and delivery. Online orders make up 60% of Hema’s revenue. “Elsewhere, online is an accretive sales channel for supermarkets,” says Norris. “But for Hema, online orders can be considered its core.”

Operators in other countries are using automated warehouses and out-of-town superstores, but such models cannot meet Hema’s commitment of delivery in 30 minutes within a three-kilometer radius. “Although numerous, their online orders carry much lower margins than in-store transactions because delivery is free of charge to consumers,” says Jing. The model also encourages smaller orders and Norris says that the average order is only around RMB 90. Although the COVID-19 crisis increased the number of orders and attracted many new customers, the average value of orders was reported to have dropped to around RMB 40.

Addressing the issue, Freshippo/Hema has introduced a membership program with benefits such as a 14% discount for orders made on Tuesdays. “This program nudges shoppers toward a weekly grocery shop,” says Norris. “Previously, most Chinese households would buy groceries multiple times throughout the week. Now, Hema’s captured that weekly spend at the start of the week.”

The right habitat

Underlying the emergence of the trend was the widespread adoption of smartphones around a decade ago. “It is the key to enable, drive and unlock the future of retail, or ‘New Retail’ as Jack Ma describes it,” says Gutteridge. “The smartphone has almost become an extension of a user’s anatomy.” Crucial here, he believes, is the duopoly of the online payment systems, WeChat Pay and Alipay, along with their integration into social and commerce experiences.

If this was the enabler, the push for integration has come from rising digital advertising costs—an earlier proliferation of online-only sales was fed by cheap digital advertising. “Successful online-first brands in China, like Three Squirrels [an emerging food brand] and Perfect Diary [a makeup brand] recognized this shift and announced ambitious offline expansions,” says Norris. “One thing that’s interesting about these digital-native brands’ embrace of offline retail is, they tend to view offline stores as a form of marketing.”

Retailers are trying to create a seamless experience between the online and offline worlds. Freshippo/Hema, for instance, uses digital pricing, meaning that it can instantly change prices for both channels. It also feeds into the demands of today’s consumer for instant gratification.

“Everything is so fast in China, with mobile payments and excellent customer service, so why should shopping take longer than anything else?” asks Noel. “The ‘see now buy now’ (SNBN) trend is therefore what drives demand the most.” Helping China to be at the forefront in new retail is massive data collection. Noel says that less resistance to the idea of data collection from consumers in China compared to Europe has powered China ahead in technical innovation and artificial intelligence.

And it is AI that is likely to shape how retail will look in the future. “By integrating AI in new retail in China, retailers can find a better way to improve business efficiency, as well as provide a holistic shopping experience for customers,” says Noel. Sensors can already monitor aspects such as the mood of a customer. “What we are seeing here is what was once simply a store that focused on sales is now an experiential center that gives consumers the opportunity to socialize, discover, eat, drink, learn, share and participate,” says Gutteridge.

Sink or swim

Hema has an obvious first mover advantage in combining the online and offline shopping experience, but with many traditional supermarkets now also offering online ordering for fresh foods, it must work to stay ahead of the game. China’s consumers are notoriously price-sensitive and brand loyalty is not deep.

“Consumption of Hema products in Xi’an is not high,” says Xiao Jin who lives only 300 meters away from a Freshippo store in the northwest China city but does not use it as her main supermarket. “Compared to other supermarkets, Hema’s prices are slightly higher.”

Also the concept is heavily dependent on a cheap migrant workforce—the motorcycle brigade—who often work in poor conditions and under great pressure. The long-term sustainability of that logistics model is questionable, but in the short term, the availability of quality fresh foods delivered to the door within a half-hour strikes a chord with many customers.

“Hema has more kinds of vegetables and focuses on the concept of freshness and quality, other supermarkets only tend to sell goods instead of a new and healthy way of life,” says shopper Miranda Liu. A reliance however on predominantly single customers and young couples without kids may prove a problem in the long term.

For the moment, the Hema/Freshippo concept appears to be working. The supermarket chain has created a model in China’s biggest cities that can be rolled out across the country. It has a first-mover advantage and the backing of Alibaba. And Gutteridge highlights how Hema’s strength lies in the choices it provides consumers.

“Hema is a true omnichannel retail provider,” says Gutteridge. “Unlike established supermarket brands found elsewhere, they’ve created a proposition that focuses on delivering a seamless, non-linear experience rather than one that’s delivered piecemeal.”