The COVID-19 crisis turned taking online classes from being a mere option to becoming an absolute necessity. What does this mean for businesses working in the virtual education sector?

The coronavirus outbreak hit China first and hit it hard, forcing businesses to shutter and schools to close, but the stringent measures put in place to contain the spread of the virus has had a huge benefit for at least one industry: online learning.

With students still in need of an education, online classes have gone from being a mere option for students and parents to becoming an absolute necessity. Hundreds of millions of students and teachers suddenly started using online platforms to conduct school classes, and it is already clear that it is not a temporary phenomenon.

“All of our students are now taking lessons online,” says Wang Yi, a teacher at a private bilingual school in Jiangsu, a coastal province north of Shanghai. “We originally started out teaching math, Chinese and English online, but we have since added other subjects to our students’ schedules as time went by.”

For the growing number of companies that provide online tutoring services, this trend represents a massive business opportunity.

“On January 23, we were told that all of the schools will be closing, and from one day to the next, everything changed,” says Jesper Knutell, executive vice president and general manager of Education First, an international education company headquartered in Switzerland that focuses on the China market. “In the three weeks following Lunar New Year, we managed to migrate up to 150,000 students online, from young children through to adults. After that, a further 10,000 students were added to our online education structure every day.”

Doing the math

With regular schooling, from primary to university levels, all being conducted in virtual classrooms during the virus outbreak, interest in extra tutoring online in subjects such as English, mathematics, science and music also surged. But the shift in interest toward online tuition had already started well before the virus.

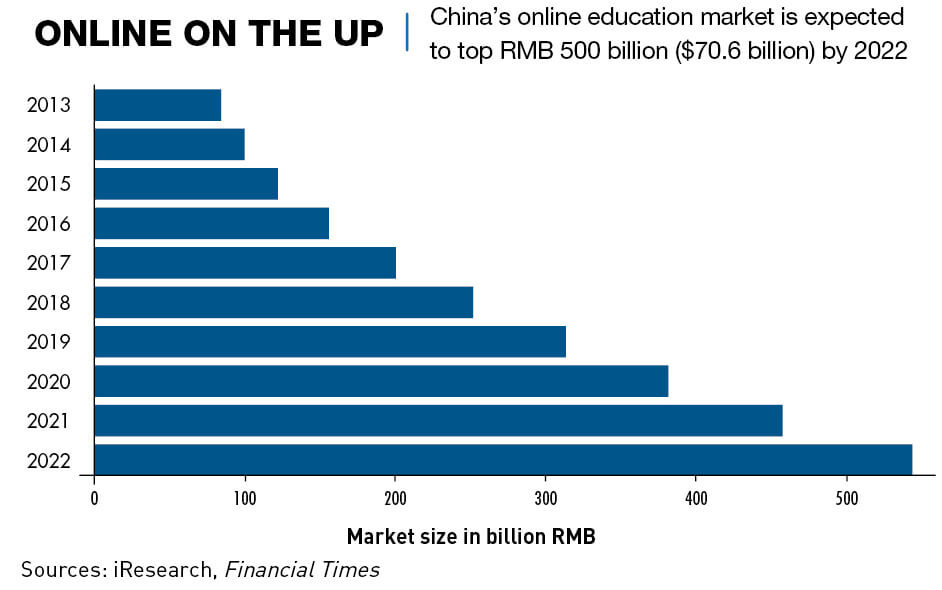

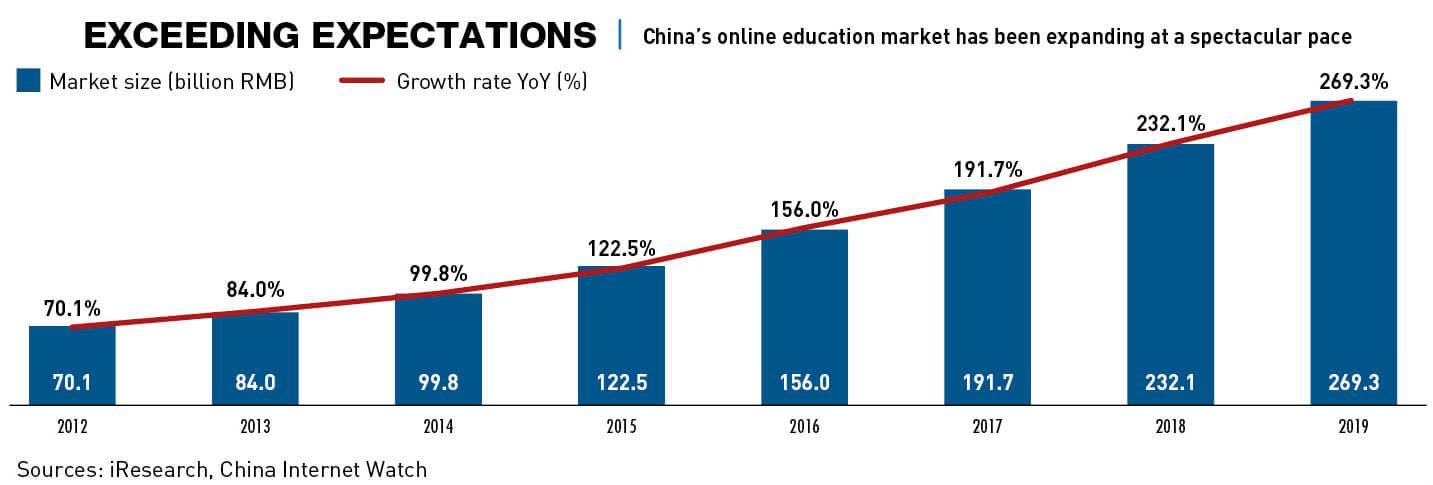

According to the China Internet Network Center, a government agency, the domestic online education market already numbered 200 million users in 2018, seeing year-on-year growth of 25.7% to reach revenues of RMB 251.7 billion ($35.9 billion). The sector was expected to grow 12.3% to RMB 435.8 billion ($61.5 billion) in 2020 according to the marketing group iiMedia Research, but in the wake of COVID-19, it should be much bigger.

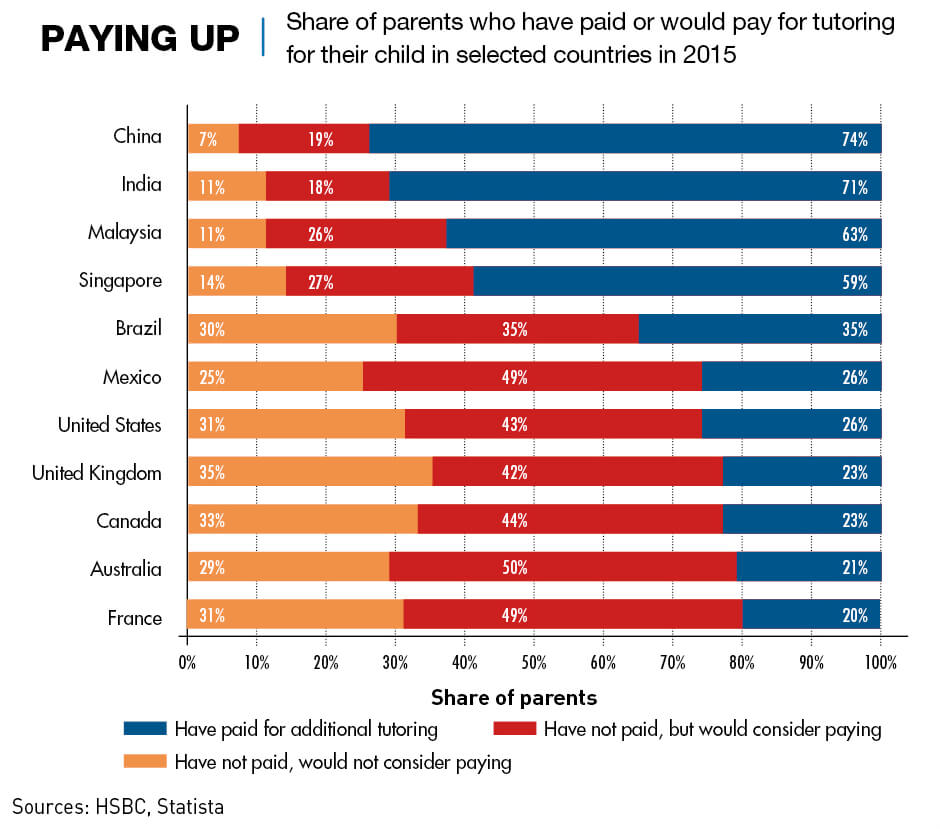

When it comes to spending on their children’s education, Chinese parents have always outdone their Western counterparts to a significant extent, and just about every child in China’s major cities takes extra classes in the evenings or on weekends. HSBC Group reported in 2017 that 93% of Chinese parents pay for private tuition or have done so in the past, compared to the United Kingdom’s 23% and Australia’s 30%. That translates to Chinese families forking out an average of $42,892 on each child’s education, far surpassing the amounts Canadian ($22,602) and French ($16,708) moms and dads shell out.

“Nobody really taught us to place such an emphasis on education, it’s just in our blood,” says Wang. “Chinese culture developed under a Confucian background and lessons from our ancestors. Even though fees for classes are becoming higher and higher, parents are willing to make great sacrifices to pay for their children’s mounting education-related fees.”

The higher spending levels on education are driven not only by culture, but also by the highly competitive nature of the education system and the country’s huge number of people.

“The sheer size of China’s population means that there is a great deal of competition to get into the best schools, the best universities and secure the best jobs,” says Natasha Galasyuk, a teacher at EIC Scholar Tree, an English language training center in Shanghai. “Extra classes are seen as a way to make sure that your child is not left behind.”

Best of both worlds

This trend towards online education has compelled parents, teachers, students and online education providers alike to re-evaluate the whole future and nature of the teaching process.

“With the virus forcing everyone to stay at home, China became a massive global experiment in how we deliver online education,” says David Mansfield, executive headmaster of the YK Pao School, a bilingual school located in Shanghai. “It’s something that people were beginning to experiment with, but it has now been forced to the forefront out of necessity.”

The benefits of taking classes online are clear. Students avoid lengthy commutes, study from anywhere with a stable internet connection, connect to teachers all over the world, play recorded videos on repeat to ensure optimum understanding and progress at their own pace.

“Online classes are more convenient,” says Shimeng Hu, a 13-year-old student in the city of Wuxi in Jiangsu province. “My mom also quite likes that she doesn’t have to sit in traffic every morning to drop me off at school.”

“Online learning fits into busy lifestyles,” says Knutell from Education First. “If you have a quick 20-minute gap in the day while you’re on the bus, you can pick up your phone and learn something, whereas that level of flexibility is impossible when it comes to in-person classes. With virtual learning, we are also able to match the best teacher in the world with the student, no matter where they are located.”

In addition, some subjects seem more suited to being taught online than others.

“Subjects such as math and science are better taken online,” says Knutell. “When a student doesn’t understand how to do a sum, for example, they can watch the teacher explain it on repeat until they do, instead of stopping a whole class full of kids. Language learning tends to be more interactive, however, and so the value of offline classes is still there.”

While the convenience of online classes is undisputed, teachers and students still see the importance in having face-to-face classes, particularly for younger students.

“I know that some of my students are totally fed up and itching to get back to class,” says Elizabeth Thomas, a grade school teacher at Veritas Academy, a foreign-managed high school in the city of Rui’an, about 500 km south of Shanghai. “The worst thing is not being able to communicate with my students on a personal level, observe them properly and identify those who need my help.”

“For younger children, it becomes really important for their parents to sit beside them in each lesson to make sure that they’re following and using the software correctly,” says Galasyuk. “For those whose parents are working or unable to sit with them for the duration of each lesson, they are actually falling behind.”

Many students—although not all—also miss the social interaction of the traditional classroom environment. “I prefer going to school because I get to talk to my teacher and play with my friends when I’m there,” says Huangyun Ji, a 12-year-old middle-schooler in Jiangsu Province.

Teachers and businesses alike feel that while online education may be growing in popularity and has huge prospects, it isn’t something that can replace offline teaching altogether.

“Online teaching will never be able to replace traditional teaching, but the two modes may be able to complement one another,” says Galasyuk. “They need to be used in parallel for the best outcome.”

“The impact of this is going to be that consumers and students in general have opened up their eyes to online education,” says Knutell. “Most may have thought that digital learning would be quite boring and one-dimensional. That’s something which has changed. Students and parents are seeing that there can still be a bond between the student and the teacher, even with online learning.”

“What I think is going to happen is that part of education will move online, while part of it will stay offline,” he adds. “I don’t think all of it will move online, but the balance is sure to change.”

The backing of tech

China’s centrally controlled system allows for a coordinated and efficient response to exactly the kind of problems created by the coronavirus outbreak. When it hit, the Ministry of Education quickly issued an order to all schools to use internet platforms to teach students, and launched a national cloud learning platform.

The Ministry of Industry and Information Technology roped in the three major telecommunications operators—China Mobile, China Telecom and China Unicom, all state-owned—and tech companies including Alibaba, Baidu and Huawei to back up the e-learning platform with 7,000 servers and 90 terabytes of bandwidth, which ensured that the platform can run smoothly with up to 50 million students using it at the same time, said state-run CCTV. With the country’s internet penetration reaching 854 million people as of June 2019 and an internet availability rate of 61.2%, according to Xinhua News Agency, it created a quickly assembled viable alternative to school education.

Overall, technology has assisted hugely around the world. There are now a multitude of apps and platforms, with Skype and Zoom being used by teachers everywhere. “We use Zoom and I’ve found it to be a well-developed platform,” says Galasyuk. “I can control both my screen and the screens and audio of my students.”

Other companies, such as English First, have spent years developing their own online teaching platforms. “We have a team of 200 developers constantly improving our platform,” says Knutell. “Integrating consumers’ feedback is important.”

The champions

But online education companies in China are in a league of their own, with the COVID-19 virus providing an extra boost. It’s not easy for a company to reach “unicorn” status, with a value of over $1 billion, but China now has several in the education field. Some of the biggest names are DadaABC, Knowbox, New Oriental, Tal Education Group, TutorABC, VIPABC, VIPKID, Yuanfudao and Zhangmen 1 to 1.

According to education market intelligence provider HolonIQ, the top three unicorns in the online education industry based on valuation are Yuanfudao which provides tutoring in subjects including math and English, VIPKID which offers English courses, and Knowbox, a homework managing app. All three target children and are valued at $7.8 billion, $4.5 billion and around $1 billion, respectively.

As the trend toward virtual education continues to gain momentum, new companies and mobile applications are being created at a breakneck pace, all in the hopes of benefiting from the gold rush.

“Education is rapidly becoming much tougher and more competitive and they’re all competing for market share,” says Mansfield. “Not all will survive and there will be a lot of M&A in the market in the next few years, but the market will still grow. It’s going to be the investors with lots of money, who are willing to wait maybe five to 10 years to get a return on their schools that will begin to see a profit. And once they have cash in the bank, they will be able to buy up other schools. The market is a strong one, it’s just a difficult one to make a lot of money quickly.”

“You can look at education businesses in two tracts,” says Knutell. “Those that have online options have been seeing demand increase. Those who didn’t, have been scrambling to move everything online. Online learning and offline learning are the same in the sense that it’s ultimately all about the experience. So, if you’re not able to deliver the same high quality online that you do offline, your brand will be impacted.”

Anytime, anywhere

The coronavirus crisis and the underlying education trends in society have translated into a massive opportunity for Chinese companies offering virtual education, but they also create opportunities for teachers around the world to offer services into the China market.

Almost all the teachers teaching on online learning platforms are working remotely, meaning that they can be located nearly anywhere in the world. When looking at English teaching, for example, market research and management consulting firm Daxue Consulting, estimates that 100,000 English teachers are still needed in China. Supply simply does not meet the demand. But when considering online education, suddenly the problem is solved.

“I teach English to Chinese students online for around $18 an hour,” says an American based in Indonesia, teaching through VIPKID. “It’s a location independent job, so I’m literally able to teach from anywhere in the world as long as I have a stable internet connection.”

The changes also present an opportunity for companies looking to develop new software. The most popular software programs in use in China include Alibaba’s Dingtalk, ByteDance’s Lark, Tencent’s WeChat Work and Zoom. App rankings compiled by data compiler Sensor Tower show that Dingtalk experienced 1,446% year-over-year growth in downloads, Lark experienced 6,085% and WeChat Work 572%.

New-found familiarity

Being left with no alternative but to start taking lessons online during the virus crisis has made both children and parents become more familiar with online classes and led to the realization that a virtual education is in fact viable. This new-found familiarity is likely to push the market to grow at an even faster pace than it was already doing.

“The growth trend and investment [in online education] will continue, because as China continues to look outwards, the need for an international education continues to grow,” says Mansfield. “As second, third and fourth tier cities join the market it will only become even bigger. The problem then is whether you can generate genuinely effective products with good quality teaching at a price that’s affordable to the local market. We’ll wait to see how that balances out over time.”

“In the next 10 years, the online training market will have a much bigger market share that it has today,” says Knutell. “Will it replace an offline education? No. But companies that are able to capitalize on both will be the survivors in this competitive industry.”