The rollout of 5G is making global headlines, with everyone now wanting to connect to the internet with the new technology, and China is at the forefront. How is the race shaping up?

The battle over the installation of the next generation of telecommunications equipment around the world can sometimes seem almost as intense as the Cold War that followed World War II and for a good reason—the stakes are high because 5G technology is likely to change life and business fundamentally around the world.

The new standard offers speeds up to 100 times faster than 4G, and latency (the delay between sending information and that information being received) up to 120 times lower. The 5G standard also promises to transform our daily lives with smart cities, self-driving cars and medical breakthroughs, as well revolutionizing military and security technology. The main players over who will control the future of 5G technology are China and the United States.

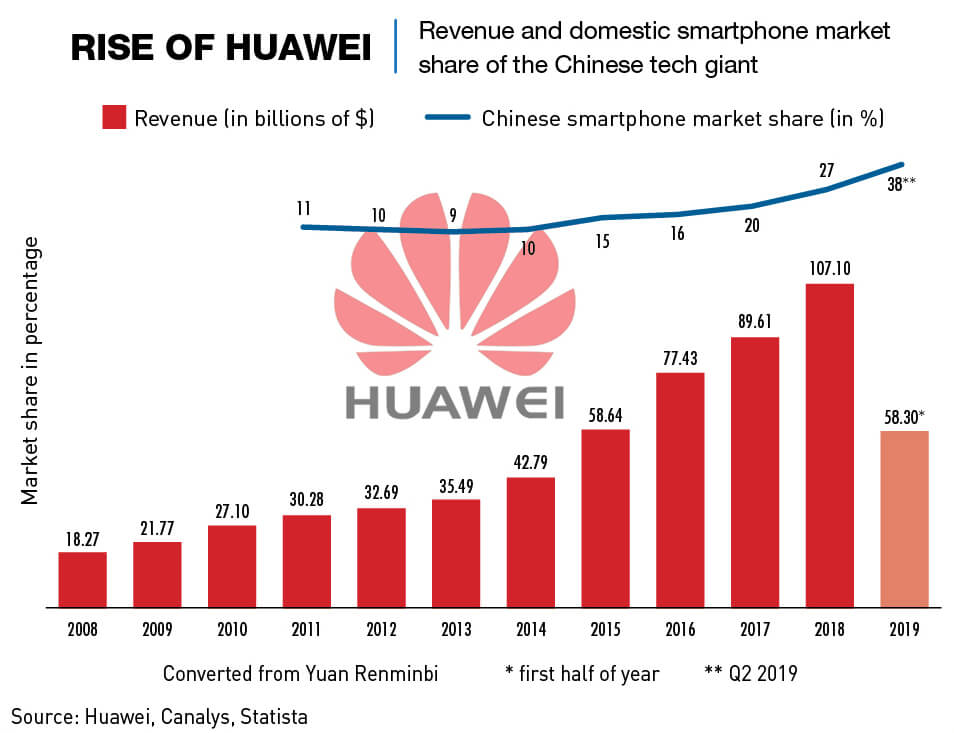

On the Chinese side, the most prominent player is Huawei Technologies, China’s biggest telecoms equipment firm, which has been accused by the US of placing backdoors in its telecommunications networks installed around the world, providing data access to Chinese intelligence services. The US has launched a campaign to stop countries installing Huawei equipment, but Huawei has categorically stated that “there is absolutely no truth in the suggestion that Huawei conceals backdoors in its equipment.”

“I believe the US government is right to be cautious,” says Adam Segal, an expert on Chinese technology policy and the National Security and Director of the Digital and Cyberspace Policy Program at the New York City-based Council on Foreign Relations. “There will be vulnerabilities in all 5G networks, and countries have to be able to trust the manufacturer.”

“The Huawei case is simple. Networks are about trust—the world doesn’t trust China’s national companies (rightly so),” tweeted Kyle Bass, Chief Investment Officer at Hayman Capital Management, a Texas-based Hedge Fund.

The United States has mounted a strong campaign to convince countries that Huawei poses a threat, and both Huawei and the Chinese government have worked hard to get countries to include Huawei in 5G rollouts. The issue has placed many countries in the uncomfortable position of having to choose between the United States and China. Who is your best friend? That is the question people have to ask themselves.

The top global telecommunications equipment vendors offering 5G solutions are Huawei and ZTE from China, Finland’s Nokia, Korea’s Samsung, Sweden’s Ericsson and Qualcomm from the US. The US market is the world’s biggest for telecoms equipment and it is now clearly off-limits to Huawei. Australia has blocked both Huawei and ZTE from providing equipment for its 5G network, and New Zealand has blocked a mobile company from using telecoms equipment made by Huawei over national security concerns, but not Huawei directly. Vietnam, China’s neighbor, chose Ericsson to build its 5G network.

The European Union told its members that they should limit so-called high-risk 5G vendors, a category that includes Huawei, but stopped short of recommending a ban on the firm. Britain has announced a compromise arrangement that will provide Huawei with some access to 5G contracts not related to sensitive areas in the core of its system. Brazil has announced it will include Huawei in its 5G network rollout despite US pressure, and so has Cambodia, a close ally of China. “It is competition, and other countries are trying to avoid making a choice between Beijing and Washington for as long as they can,” says Segal.

Racing to the top

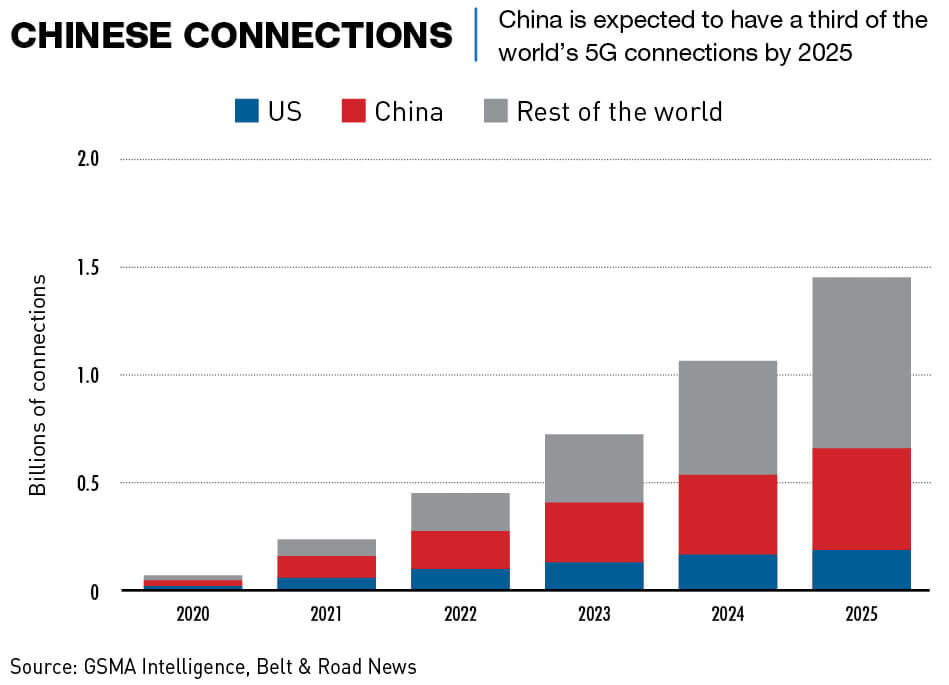

Huawei’s advantages in the competition include the significant support it receives from the Chinese government, and also the huge commercial opportunities provided by its home market, from which other vendors are largely barred. China is projected to have 460 million 5G connections by 2025, which would make it the largest 5G market worldwide. It is also rolling out 5G equipment at least as fast as the other providers.

China Mobile has already created the world’s largest 5G network by building over 50,000 base stations nationally by the end of 2019. And despite the intense international pressure on its business, Huawei has recently released a highly competitive 5G phone and posted significant revenue growth.

But while Huawei has been roundly denounced by the US as an evil telecom empire, subsidized to the tune of $75 billion by the Communist Party according to the Wall Street Journal, it is actually Sweden’s Ericsson that is the largest provider of 5G hardware globally.

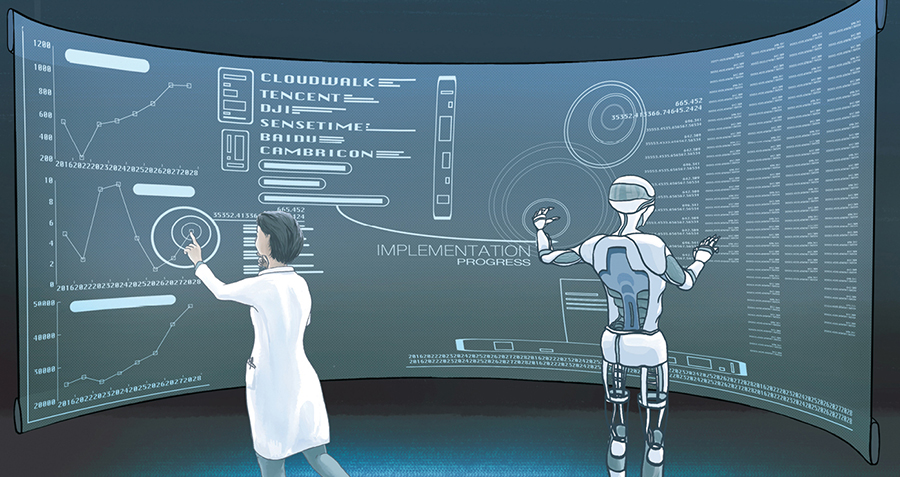

Segal says he is not convinced that 5G is such an existential threat to the West. “There is no US company that does all the things that Huawei does, and China is rolling out base stations and 5G networks faster. But we are still waiting to see what the services that ride on top of 5G are, and the US will be competitive there,” he says. “Also, there are some alternatives, especially O-RAN (Open Radio Access Network), where the US could promote more competition.”

O-RAN is a mobile telecommunication system that implements radio access between devices such as a mobile phone, a computer or any remotely controlled machine, and provides connection with its core network. It is also bringing together many of the world’s leading telecom providers who want to develop openness in access networks. The founding of the alliance was forged between five main operators—AT&T, China Mobile, Deutsche Telekom, NTT DoCoMo and Orange.

Patents

The key use of 5G’s faster network speeds will be to connect billions of devices, from mobile phones to household appliances, cars and streetlights. Over time, experts predict, all economic activity will be influenced by the new 5G infrastructure, accelerating the digital transformation of companies and society.

The rollout of 5G has been described by the European Commission as “one of the most critical building blocks of our digital economy and society in the next decade,” as it will be the main driver of the Internet of Things (IoT).

Patents are one of the key factors at the heart of the dispute. Qualcomm’s dominance of patents related to 4G telecoms technology almost resulted in the complete shutdown of the Chinese firm ZTE in 2018 when it was denied access to all US technology as a result of accusations that it had broken US sanctions related to business dealings with Iran. Huawei has put a huge amount of effort and money into developing its own 5G-related patents, and has the most patent applications filed, but for now does not hold the most 5G patents.

“Nokia and Korean companies LG and Samsung have the most ETSI-declared 5G patents, says Aaron Wininger, a Silicon Valley attorney and director of the China Intellectual Property Practice at the San Jose, California-based law firm Schwegman Lundberg & Woessner. “While Huawei has the most declared patent families, their granted patents are lower than [Finland’s] Nokia, LG and Samsung.” ETSI is a European organization that sets industry standards.

The declaration of a patent application is no guarantee that it will be accepted, and many patents are never declared. “Also, it takes several years for patent applications to be examined and granted, so it’ll be hard to judge who the true leader will be, although based on numbers alone, Huawei might take the lead eventually,” Wininger adds.

US companies Apple and Qualcomm are also important patent players, with Apple having last year bought Intel’s modem business. “Qualcomm and now Apple have large patent portfolios in the space,” he says.

The cost

Telecom providers in Asia, Europe and the US are already marketing and selling 5G packages even though implementation of the service remains slow and spotty, both in terms of infrastructure and 5G-capable appliances and applications. But one way or another, 5G is expected to be widely available in many markets by the end of 2020.

The first mobile phones that support a 5G network have been available in major markets around the world since last September. Apple is widely expected to announce 5G smartphones later this year, with chips supplied by Qualcomm. Huawei and Samsung, on the other hand, began selling 5G-enabled smartphones in 2019.

The economics of 5G for telecom companies is still not clear. The current 4G standard was launched in 2009, but many telecom providers have struggled to recoup the massive investment that was needed to create the network. According to a 2018 report by business consultancy McKinsey & Company, mobile operators are therefore approaching the 5G launch with a mixture of “resignation and anticipation.”

“They know that it will open opportunities to capture value from new 5G use cases and the widespread adoption of the Internet of Things (IoT),” the report stated. “At the same time, they are keenly aware that they’ll have to increase their infrastructure investments in this technology. Meanwhile, operators will still have to upgrade their 4G networks to cope with growing demand. In an analysis of one European country, we predicted that network-related capital expenditures would have to increase 60% from 2020 through 2025, roughly doubling total cost of ownership during that period. This conundrum raises important questions about investment strategy and future profits for mobile players.”

Some consumers have also expressed concerns about 5G in terms of 35.49 potential 35.49 spying and health issues. In California, some local authorities have banned 5G based on cancer concerns.

Unlike China, the US has so far not put any government funding into the technology, leaving it to the private sector. The low US unemployment rate is hampering this effort, along with the US government’s unwillingness to offer a financial boost.

US Democratic presidential candidate Andrew Yang recently wrote on Twitter: “The race to deploy 5G is on between the US and China—this is a race we must win. I would scale up federal investments and coordination and fund the training and apprenticeship of tens of thousands of technicians.”

“It’s almost a crisis,” Jonathan Adelstein, president of the Wireless Infrastructure Association, recently told the news service Politico. “Because if it’s not a crisis today it will be by tomorrow if we don’t act now. You can’t just invent a new workforce overnight. The lack of a properly skilled workforce is a top obstacle we’re facing right now to winning the race to 5G.”

China, meanwhile, has pumped billions of dollars in the construction of its own domestic 5G network, according to a report put out by the Center for a New American Security.

“China can much more quickly redeploy labor,” Adelstein added. “They have much cheaper labor and much more readily available labor than we do. So, if they make it a national priority, they can use state instruments to quickly ramp up and clear blockages to broadband.”

The situation in the United States might be changing, however. In January, Congress debated three bills with bipartisan support aimed at creating a national strategy to build out networks, secure the networks from cyber-attacks and steer international wireless policy.

“All three of these bills are important for securing America’s wireless future,” Energy and Commerce Committee Chairman Frank Pallone, Jr. and Communications Subcommittee Chairman Mike Doyle said in a joint statement.

What’s next?

The US and China signed a trade deal in January under which China agreed to “end its long-standing practice of forcing or pressuring foreign companies to transfer their technology to Chinese companies as a condition for obtaining market access, administrative approvals, or receiving advantages from the government,” according to a US government announcement.

But the fundamental competitive nature of the relationship, especially in the area of technology and particularly highlighted by the 5G global rollout, means that the deal is unlikely to solve the problem.

“Assuming China follows through, this would represent an enormous change to Chinese practices both at home and abroad,” says Christopher Balding, an associate professor at Fullbright University in Vietnam and a well-regarded China analyst. “Realistically, this is unlikely to change Chinese behavior and will likely be one of the examples used when this deal blows up.”

But then in a twist to the whole 5G story, China announced in November that development has already begun on 6G. It’s a brave new world.