Social credit systems are rapidly being rolled out in pilot cities across China. What affect will they have on the future?

China’s controversial social credit system is already being trialed in many cities in the country. What has its effect been and what can be expected in the future?

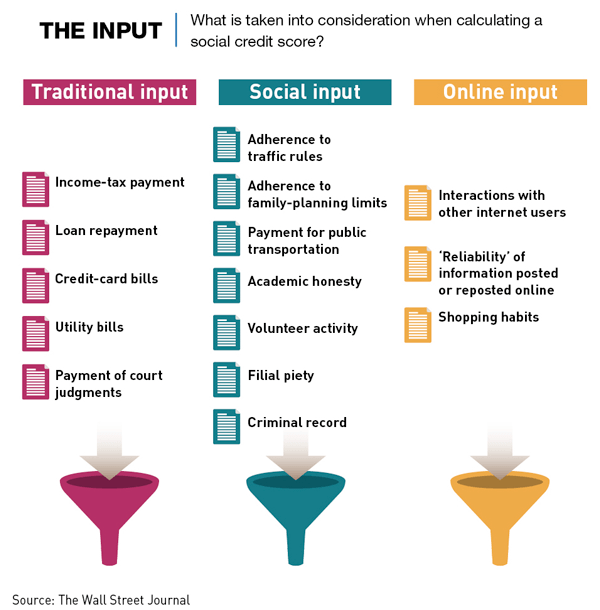

Imagine living in a world where your actions are monitored and filtered into a database, which then creates a score for your social standing. A world where your public behavior, tax payments, purchases, legal affairs, social media activity and financial records, in addition to images gathered from millions of surveillance cameras and processed by facial recognition software, are all taken into account, judging whether or not you are a “trustworthy citizen.”

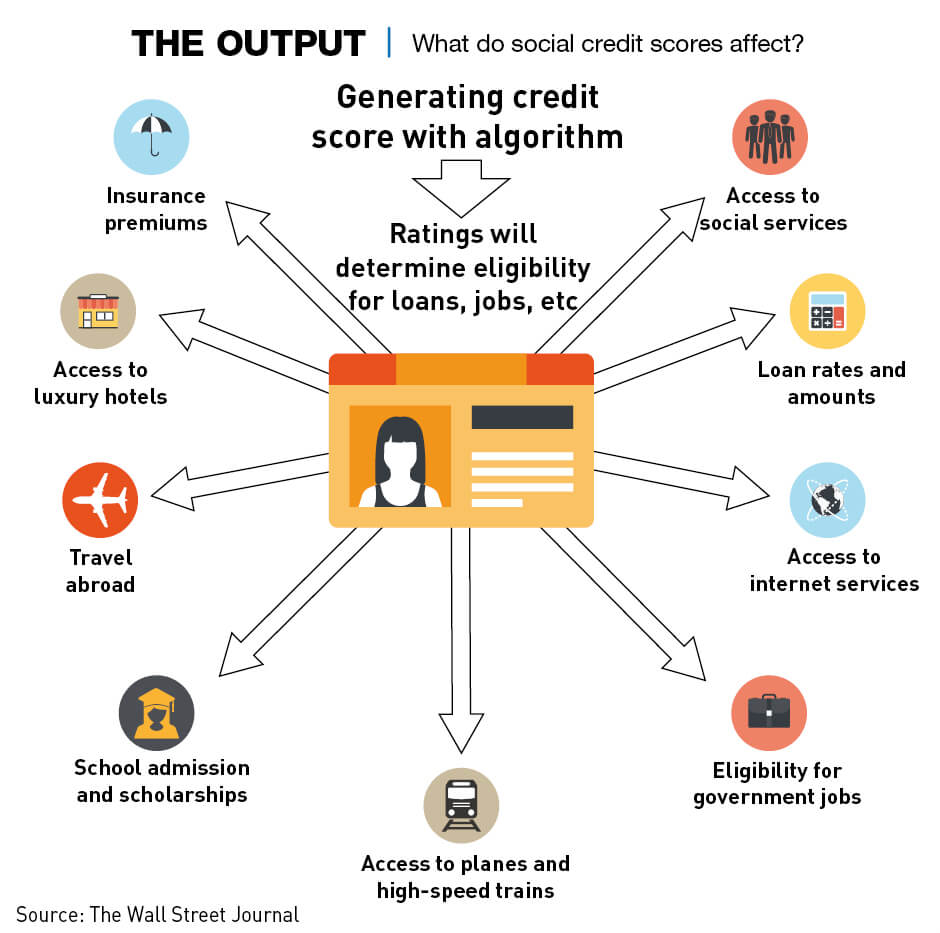

This system of social control, already a reality for many Chinese citizens, is due to be rolled out nationwide. But it is already having an impact in the areas where it is in place. Low social credit scores barred 23 million people from buying air and rail tickets in 2018, while another 290,000 people were stopped from obtaining management-level positions, according to a report released by China’s National Public Credit Information Center in February.

The social credit system, first announced in 2014, aims to support the idea that “keeping trust is glorious and breaking trust is disgraceful,” according to a State Council notice, and is due to be fully rolled out by 2020. Much like the private financial credit scores already used all-around the globe, social credit scores for individuals, businesses and other entities can move up or down, providing access to certain financial services and credit based on the score. Unique to the social credit system, however, is how “punishments” can also be served, should a score reach a less-than-desirable point.

Foundations of trust

Some local governments across China have already implemented their own pilot versions of the system.

“Cities such as Shanghai and Xiamen have developed their own algorithms to calculate credit scores, but there is no national system in place as of yet,” says Lu Li, a research data analyst at China-focused consulting firm Daxue Consulting. “The one currently being used is based on the financial credit system of the People’s Bank of China.”

“At the moment there are 43 pilots, they’re still in very early stages and every city has … a different focus,” says Genia Kostka, a professor of Chinese politics at the Free University of Berlin.

With a national system not yet in place, a specific across-the-board rulebook has not yet been fully revealed, so local governments have created systems with focal points based on each city’s individual needs.

Official statements from Beijing and the progress of the developmental trials, however, given the public a clear idea as to how the system will work and who it will affect. At present, the scope of the credit system will cover all Chinese nationals and entities operating in the country.

At the heart of the system is data that reveals compliance or non-compliance with legally prescribed social and economic obligations and contractual commitments. These are flagged and aggregated on a national level to determine the trustworthiness of companies and individuals.

If a trustworthiness score is low, the consequence can range from limiting the selection of schools available to children to the throttling of internet speeds, as well as the inability to secure loans. Those with high social credit scores, on the other hand, are rewarded with benefits such as being able to rent rooms at top hotels without having to pay a deposit, discounted utility bills and better interest rates at banks. Scores can be boosted by repaying a loan even after a bank has canceled it, taking care of the elderly and other social volunteering work.

A moral compass

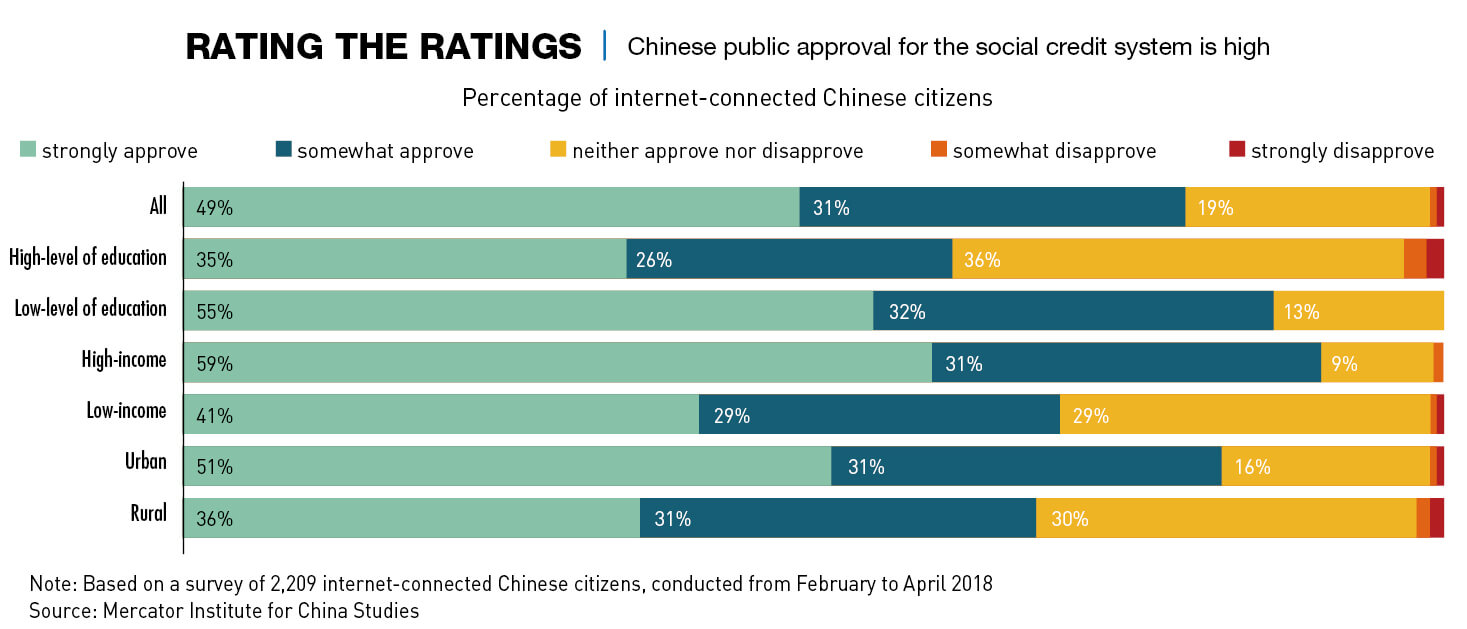

China’s social credit system has been called “An Orwellian system premised on controlling virtually every facet of human life,” by United States Vice President Mike Pence, but it has a high level of support amongst Chinese people.

Kostka conducted a survey in 2018 with 2,209 Chinese citizens, revealing that a whopping 80% of respondents said they approved of the government implementing the social credit system. Only 1% reported a moderate to strong level of disapproval.

“The reason is that they really see it as a tool that can close regulatory and institutional gaps,” says Kostka. “Chinese people are less fearful of technology than in the West and they’re already used to the public security bureau collecting their personal data.”

She explains that because of how China went through a rapid level of transition over the past 40 years, levels of trust throughout much of society are low.

“Seventy percent of people that I interviewed in my research said that there is an issue of mistrust in Chinese society. The social credit system is just seen as a tool to help make consumers or individuals make decisions based on trustworthiness,” says Kostka.

A lack of awareness

“I support the idea of the social credit system. There are often people eating and littering on the metro with no sense of shame or civic virtue,” says Fang Luofan, a 24-year-old student in Beijing. “China has been focusing on high-speed economic development for many years, but developing social standards didn’t receive the same amount of attention.”

The system is also seen as a way of addressing more deep-rooted issues such as the mismanagement of resources.

“We didn’t have this kind of system in China before, and there were many issues such as poverty, corruption and other unethical behavior,” says data analyst Li. “But this tracking system could help improve the management of the country and I believe it will assist us in building a better society.”

There is also a brief that the system will positively affect the way people interact with one another.

“I think the system will help build a certain level of trust between people,” says Wang Jia, a translator living in Wuxi city, west of Shanghai. “People will become more likely to keep their word.”

Despite the general support that the public has for the system, few are aware that they are already being rated by it in the various pilot systems running across the country.

“In my survey only 7% of the over 2,000 respondents said that they are part of a government system, but when I checked, 43% of them actually live in areas that are running pilot systems,” says Kostka.

“This lack of awareness … has to do with how local systems are currently more incentive-based and not punitive,” says Maximilian Mayer, assistant professor at the University of Nottingham Ningbo China. “The only national-level punitive action has been in stopping people from buying flights and trains tickets thus far.”

The obvious question stemming from this is: how can a social credit system alter the behavior of individuals when they have never heard of it?

Enter the enterprises

While the media and public originally assumed that the system would mainly focus on the monitoring of individuals, the pilot systems have shown otherwise. All companies registered in the cities in which the pilot systems are running were brought into the social credit system at the beginning of 2018.

“Most cities are focusing on businesses at present, only a few are focusing on individuals,” says Kostka.

The way the social credit system works for businesses seems to be different to how it is used to rate individuals, but so far little has been revealed about the specific standards that businesses are being held to.

“The government doesn’t use scores for businesses per se, which I think is the right way to do it, they separate companies onto black and red lists,” says Kostka. A “red list” in China indicates approval.

Despite the current lack of transparency on the rules for companies, the trust that the system could build in doing business in China, could be a benefit for many. If a business is on the red list, it would be strong proof that it is credit-worthy and has operated well in the past.

“On the bright side, these kinds of the systems may generate a positive force for financial markets and risk assessment,” says Mayer. “It might improve customer security, product quality and the behavior of millions of companies in China. Traditionally, China suffers from being a low trust society.”

But if a company were to be added to the blacklist, it could be banned from operating or barred from government procurement contracts. “If you have a positive rating then you have an elevated standing with government procurement,” says Kostka.

But the system could work more to the benefit of larger companies, with smaller firms facing difficulties in recovering from a blacklisting.

“It’s a double-edged sword. In China there are many small- and medium-sized enterprises, and due to a lack of transparency, they don’t get access to loans and bonds as easily as larger companies,” says Li. “But I think because the system will ensure a more transparent level of information-sharing in the future, it may help these smaller business get better financial support from banks and other financial institutions.”

The other side of the coin for companies is the expense involved in maintaining a high score. Companies might, for instance, have to re-evaluate their PR approaches or adapt their business operations to become more environmentally friendly. “Smaller businesses might not have the finances or capability of changing their score,” says Mayer.

Many local governments are also making use of existing private credit scoring mechanisms that insurance companies, big tech firms and other large commercial companies have already developed. Naturally, these companies also see the social credit system as a valuable opportunity to collect data to learn more about consumer behavior and patterns.

A commonly-used system is Sesame Credit, a private credit scoring and loyalty program system developed by Ant Financial Services Group, an affiliate of the Alibaba Group. It uses data from Alibaba’s services such as purchases carried out on Alibaba Group websites to calculate scores.

“The system is not fully developed, but what is being used at the moment, such as … Sesame Credit, is quite transparent,” says Li. Financial institutions and banks are able to access Sesame Credit scores. It’s much more difficult for documents to be forged or to find a way around the new system.”

While certain elements of the system may improve transparency in terms of how companies’ scores would be visible to vendors and customers, some experts are not completely sold. The opaque nature of the system, they say, still leaves questions unanswered.

“It’s not clear how the system would prevent corruption, how easily it could be hacked into to create a black market for score manipulations and whether scores would be fair toward smaller businesses,” says Mayer.

The extent to which foreign companies will be impacted and in what ways is also not yet clear.

Cause for concern

The social credit system has sparked a debate internationally. Despite the high level of public support for the system in China, Kostka says the two main problems to be addressed in order to ensure continued public support are transparency and fairness.

“People feel that they were not well-informed on how they can improve their score or how their Sesame Credit scores are even calculated. A lot of people also raised the issue of fairness, they wonder whether highly-ranked officials will be held to the same standards,” says Kostka.

“The commercial side of the credit system is very unfair for poor people because it’s linked to consumption. If you consume a lot, it’s easier to get a higher score, but if not then it’s more difficult to do so,” says Kostka. “The rewards are also not always useful, especially for people living in rural areas. A lower deposit in a hotel and faster visa processing isn’t meaningful for a farmer.”

Questions have also been raised about how this new regulatory system will work in relation to the laws and systems already in place.

“The social credit system could end up undermining the legal system in China,” says Mayer. “The system appears to contradict basic legal principles, such as not being charged for a crime twice, first by the law and again by the consequences of a lowered score.”

He highlights how the system is actually a symptom of a deeper issue. “In a way it shows the dysfunction of the legal system. Why is the legal system not enough to hold people accountable for their actions? Why does the state have to introduce this new measure?”

With increasing digitalization also comes concerns over privacy, but while the United States and Europe have been debating privacy issues for years, in China it remains a relatively rare topic and low on most citizens’ list of concerns.

“The social credit system is not seen as a system that would bring on privacy violations, it’s just seen as a pragmatic tool,” says Kostka. “I think the link at the moment is quite weak between social credit, big data and privacy, but it doesn’t mean it will stay that way, as things happen very quickly in China. As the system develops, issues around transparency and privacy will undoubtedly emerge.”

Another concern is what impact the system will have on overall social mobility.

“What the system is basically doing is the quantification of social relations,” says Mayer. “If the system works according to the vision of the central government, then social mobility would become much harder.”

“There is certain level of dependency on those you are connected with and if you have the right links to the right people it would be easier to stay on top, but for those at the bottom it would be more difficult to climb up,” says Mayer.

“If banks consider personal credit to be more important than financial credit in loan considerations, it may help the poor to change their lives,” says the student Fang. “However, if banks only focus on assets and consumption it will end up harming social mobility. People might be able to buy credit points to increase their score, but again that’s only for people that can afford to do so.”

But will it work?

While the idea of the social credit system seems alien to many people outside of China, similar systems in the West might have even been the inspiration behind it.

“The scoring of social relations happens everywhere in the world, China is not an outlier,” says Mayer. “The reality is that these systems are already in place in other countries. Consider the scoring mechanisms behind PR firms, behind advertisement strategies, behind customer profiles and behind fintech that exist in the West. China just went a step further and added political and moral elements to it.”

“It’s simply a collection of standard guidelines,” says Kostka. “Local governments are simply adding new rules to previously existing systems and renaming it the social credit system. The real difference now is that sometimes these systems also collect data and merge that data between departments.”

Whether the system will have the desired effect of improving society overall, is something yet to be seen, but Chinese people seem to be taking the system to heart.

“The names of people that don’t pay their debts have been revealed to the public before; you can even see their names listed on the televisions on public buses. I wouldn’t want my name to appear there,” says Fang.

“I was late to pay my credit card bill once,” says Wang. “Luckily, it didn’t seem to affect my social credit score, but I have since set a reminder on my phone to make sure that I pay it on time in the future.”