NetEase is the internet pioneer you may have never heard of. A dynamic survivor, the company faced down death in the dot-com bubble, and has come back as a potential challenger to China’s biggest tech firms

Nestled in the pleasant countryside of Anji County, in China’s eastern province of Zhejiang, is Weiyang Farms, an 80-hectare facility raising some 20,000 Jeju black pigs. A Wi-Fi-enabled speaker system pumps out music synced to the pigs’ waking, eating and sleeping schedules, a hint that this is not a normal pig farm. It is owned by the Chinese tech company and online games giant, NetEase.

NetEase is the Chinese internet pioneer you have probably never heard of, and it has learned the hard way that diversification is the only alternative to death. Founded in 1997, before its bigger and better-known Chinese internet peers Baidu, Alibaba and Tencent (collectively known as BAT), it is largely unknown outside of China.

Along with its founder and CEO Ding Lei, it is a dynamic survivor. Lei faced down entrepreneurial doom after the dotcom bubble, but thanks to courage, wits and diversification—largely into games—he turned the operation around and is currently ranked number five on the Forbes list of China’s wealthiest, worth an estimated $17 billion.

NetEase reported $5.5 billion in revenue in 2016, with $4 billion from online games, 60% generated from its mobile offerings, including the hit titles Fantasy Westward Journey, Speedy Ninja, and SpaceX Fighter. The company’s profit for the year was $1.7 billion, a 73% increase on the year previous. Its shares, listed on Nasdaq, have skyrocketed in recent years, and the company is currently valued at around $40 billion, and it employs nearly 13,000 people.

“NetEase is now China’s second largest online game operator,” says Peter Wu, an analyst with the Market Intelligence & Consulting Institute (MIC) in Taiwan. More importantly, the company is not complacent. “NetEase’s future trajectory as a company is to continue to focus on diversification.”

NetEase is currently making big pushes into many new businesses. In addition to pig farming, admittedly a peripheral concern for a multi-billion dollar tech company, NetEase has been investing in e-commerce, online learning, music streaming and a host of other businesses.

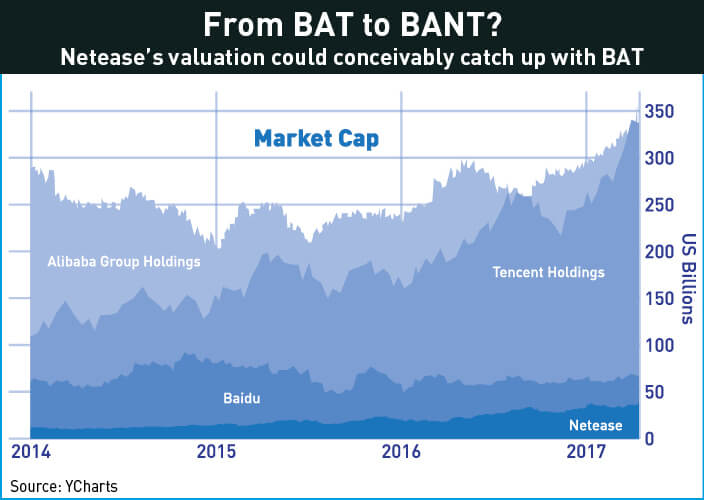

But it still has a long way to go to climb back to the top of the China tech tree, so as to turn BAT into BANT. Its valuation lags behind the others—$64 billion for Baidu, $343 billion for Tencent, and $355 billion for Alibaba. Analysts note that NetEase lacks the breadth of its rivals’ businesses, and that will likely stymie its growth, unless it can continue to diversify successfully.

“I think NetEase still needs a long way to be a top firm in the world,” says Johnny Zhou, Market Analyst with tech industry research firm IDC.

On the other hand, NetEase has surprised skeptics in the past, and has found massive success in markets where few saw any potential at all.

Early Days

Ding Lei, also known as William Ding, established NetEase way back in 1997, a time when only 290,000 PCs were connected to the internet in China, and there were only 620,000 internet users, according to an article by the China Education and Research Network (CERNET), a state-internet provider for educational institutions.

“I was one of the first internet users in China,” Ding told the South China Morning Post in 1999. “ I began to realize at that time that the internet would be very popular.”

In 1997, with RMB 500,000 ($74,000) earned from the sale of telecommunications-billing software that he had developed, Ding quit his job and set up NetEase in Guangzhou. The company first developed a Chinese-language software system that enabled internet service providers (ISPs) to offer free e-mail to China’s web surfers. Its still-current web address, 163.com, referenced the number internet users in those days needed to dial to access the web.

“NetEase is one of the four biggest internet portals, together with sina.com, qq.com and sohu.com,” says John Song, Deloitte Consulting Partner and Head of the Logistics and Transportation Practice at Deloitte China. “It is still has a solid brand name and customer base.”

Ding quickly expanded the NetEase range of services to include a search engine, online chat, news, web hosting and other services much like a Chinese version of Yahoo! By 1999, China had 6.7 million internet users. NetEase was recording about 4.2 million daily page views, bringing in $2 million a year in revenue and had 1.7 million registered users for its free e-mail service.

Investors took note. In 2000, NetEase raised $70 million and, along with Sina.com and Sohu.com, was listed on the US stock exchange, Nasdaq. However, the experience was rocky as the internet bubble burst. By mid-2001, as billions of US dollars were wiped off the Nasdaq-listed stocks, NetEase’s share value dipped to as low as 13 cents (it was valued at $300 per share in June 2017).

Adding to the company’s problems, in May 2001, NetEase announced that it had discovered accounting malfeasance in which contract terms had been misrepresented in financial statements. The readjustment removed $4 million in revenues from its balance sheets, approximately 52% of the year’s total revenues. The company was suspended from the Nasdaq and threatened with delisting. CEO King Lai and COO Susan Chen both resigned.

The wider bubble put the entire future of the internet in China into question. Duncan Clark, founder of consultancy BDA China and author of Alibaba: The House that Jack Ma Built told The New York Times in 2001 that the internet in China was being “absorbed into the traditional economy.”

Rebirth

But Ding Lei remained a believer. He saw an opportunity with the emerging online games industry, and over the objections of his own board of directors, that was where he took the company.

NetEase launched its first game, Fantasy Westward Journey, in 2001 and it became China’s first popular Massively Multiplayer Online Role Playing Game (MMORPG), in which huge numbers of players can simultaneously play in a persistent fantasy world. Inspired by the classic 16th century Chinese novel, Journey to the West, the game became a phenomenon and helped give birth to the industry.

“With Journey to the West and Journey to the West II, NetEase witnessed a great success with a whopping 449% year-on-year growth in 2003, 209% in 2004, and 119% in 2004,” says Peter Wu. The game eventually attracted some 300 million users. By 2003, Ding had become China’s wealthiest person and its first internet billionaire.

NetEase produced a string of original hits, including New Westward Journey Online II, as well as other games, such as Tianxia III, Heroes of Tang Dynasty Zero and Ghost II. “Instead of distributing games from international brands, NetEase has concentrated on developing homegrown games,” says Wu. Of approximately 40 games launched by NetEase in 2016, over 70% were homegrown.

NetEase has also teamed up with a number of foreign games makers, including Blizzard Entertainment, which owns the blockbuster World of Warcraft series, to publish many of their global offerings in China, contributing even more to the company’s bottom line. According to its first quarter 2017 finance report, NetEase revenue reached $1.98 billion, a year-on-year growth rate of 72.3%, with online games contributing $1.56 billion, or nearly 79% of the total.

The market for games is starting to change, moving from PC to mobile, but NetEase seems well set for the switch because Chinese mobile gamers are still demanding the kind of big multiplayer games that NetEase has experience in developing. But there is a lot more competition in the mobile space. NetEase released a mobile game based on the Kung Fu Panda movie franchise in 2015, which disappointed some gamers.

“At first I thought the graphics were amazing,” says Tao Jiayuan, a 28-year-old coder in Shanghai. “But after three days of playing, I discovered that it is actually just like Fantasy Westward Journey.”

In contrast, Tao said another mobile game, King of Glory, holds his attention for hours, and, indeed, it was a big hit this year. Unfortunately for NetEase, it was released by rival Tencent, which is now the largest games company in the world.

“When it comes to mobile games development, NetEase was relatively late compared to Tencent,” says Peter Wu, but he notes that overall the company has done well in catching the mobile game wave. NetEase’s online games revenue grew 62% to RMB 28 billion ($4.1 billion) in 2016, thanks in large part to mobile games.

Its continued success in the games area resulted in NetEase’s share price doubling to $300 this February from a year previous. Even at that rate, NetEase is still considered a bargain by investment analysts. Its larger rival, Tencent, has a price to earnings ratio of 50; NetEase’s is around 20.

China and Southeast Asian video gaming market research firm Niko Partners noted that while NetEase is still likely to remain second to Tencent in the China mobile gaming market, the smaller firm is catching up fast.

“Tencent dominated the China mobile games market in 2016 with around 50% market share, but NetEase’s mobile game revenues grew by more than 2X to quickly chase Tencent for the top spot,” the firm noted in publicized findings. “We expect NetEase to maintain the No. 2 spot in the market and once again grow faster than Tencent.”

Beyond Games

On the back of that gaming success, NetEase has expanded into a number of other ventures, including such diverse areas as organic farming.

NetEase still provides free e-mail services in China. It has added new and updated features such as voice search and facial recognition, as well as fee-based premium e-mail services for corporate users. “[NetEase’s] e-mail is still quite good, still widely used by people in China,” says Song.

The e-mail service currently has about 60 million users and NetEase has creatively leveraged this into an e-commerce business that is integrated into its mail services.

NetEase attracts users that tend to be more educated and have higher incomes than average. The cross-border e-commerce platform Kaola, launched in 2015, takes advantage of this by offering high-quality foreign goods at prices that it negotiates with foreign manufacturers.

“NetEase has done a good job,” says Xue Yu, an analyst with IDC in Beijing. “Growth of NetEase’s e-commerce platform is about 60% per year, far above the average [30%].”

Xue says that challenging giants Alibaba, which runs the Tmall platform, and JD.com for supremacy is more or less impossible. Rather, NetEase has managed to carve out a nice niche for high-value customers.

All told, 21% of NetEase’s 2016 revenue came from e-mail and e-commerce activities, which have actually grown faster than its gaming revenue, up 117% year-on-year.

Then there are the pigs in Zhejiang, which seemed to have begun as Ding’s billionaire hobby. “This is not an investment for NetEase or a way to make extra money. I hope that it will increase food product safety and work opportunities for rural folk,” he said in an interview shortly after starting the farm in 2009.

Even that may have changed, however. This past February, early stage venture capital firm Sinovation Ventures joined popular daily deals company, Meituan-Dianping, in a $23 million investment round in Weiyang Farms, clearly seeing promise in the prospect of artisanal pork. Such initiatives aside, it is unclear how far NetEase can stray beyond its gaming mainstay.

“[NetEase] is developing in a vertical way by reinforcing the strength of game R&D,” says Johnny Zhou. In his opinion, it is far easier for NetEase to be a great gaming company than it is for the company to establish itself in new fields.

Bigger Ambitions

NetEase is now successful enough to look to expand its presence globally. Its early moves lend credence to Johnny Zhou’s idea that it is at its core a games maker. In August 2014, the company opened up its North American headquarters in Brisbane, California, as a steppingstone, saying in a press release that CEO Ding “has ambitious goals to achieve greater results in the non-Chinese gaming markets within the next three to five years.”

A glance at the global gaming industry indicates the potential. SuperData Research Inc., a firm specializing in digital goods measurement, notes that online and mobile games generated some $91 billion in revenues globally in 2016 and $41 billion in mobile, the biggest year ever seen in the industry, with continued expansion expected.

Yet, rather than becoming a more global company, the immediate prize may be to rise into the ranks of the BAT brethren. This may be more feasible, especially with Baidu struggling to adjust its business model. In the latest Forbes list, Baidu CEO Robin Li dropped out of the Top 10 richest Chinese while Ding Lei rose to fifth.

John Song notes NetEase’s steady progress in recent years. Its focus on the customers and its overall stable business model have been built on growing revenue and profit in what can be a bubble-prone Chinese tech industry. Holding it back, however, is NetEase’s lack of a world-changing product, like Tencent’s WeChat.

“NetEase’s success is not only a one-time success,” Song says. “So maybe they will someday develop a product like WeChat and again become one of the top internet companies.”