Once known as China’s Netflix, LeEco has far outgrown its origins. Will CEO Jia Yueting’s diversification plans succeed?

China is no stranger to sprawling internet companies, with the likes of Alibaba, Tencent and Baidu—collectively known as BAT—having extended their reach into everything from mobile payments, to online video and beyond. But even in this climate, LeEco—previously called LeTV until it was rebranded in January, and which used to be known as the “Netflix of China”—stands out for the sheer range of its acquisitions, investments, new ventures and the unorthodox style of company founder Jia Yueting.

That has increasingly put the company on the radar of industry observers outside of Greater China—after this year’s Mobile World Congress, UK tech website Alphr named LeEco as the event’s most innovative company. And the company generated international headlines once again when it unveiled its electric self-driving car, the Le-SEE, in April, with the vehicle being summoned on to the stage by Jia using a mobile app.

“I can’t hold back my tears,” he said after the car had emerged from a container and gingerly made its way down a catwalk. “Everyone was questioning us and laughing at us, but we’re still presenting this car here today.”

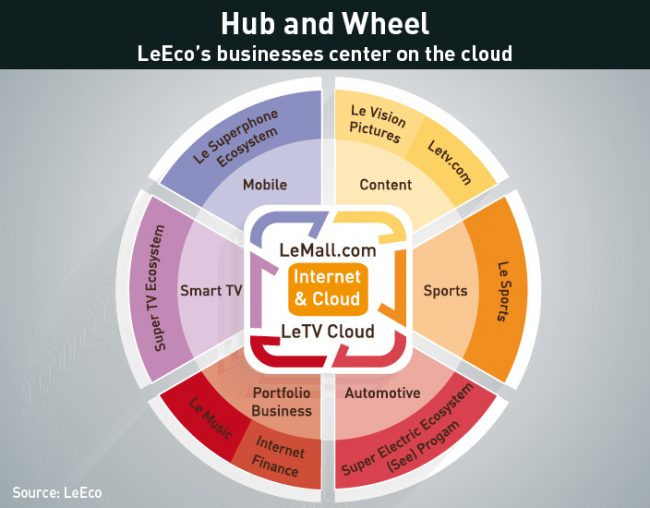

LeEco, which did not reply to CKGSB Knowledgeʼs request for comment, was founded in 2004 as an online video website which was commonly referred to as the “Netflix of China” and is now a dizzyingly diversified entity, with ventures spanning from internet TV and mobile phones to virtual reality and the aforementioned electric cars, all of which underpin its attempts to join the internet big leagues, and which are ostensibly paying off—last year revenue grew 90.89% to RMB 13 billion ($2 billion).

The company’s rhetoric matches its ambition, with LeEco routinely comparing itself favorably to the likes of Apple and Tesla—CEO Jia Yueting called the former “outdated.” Speaking at an IT summit in Shenzhen alongside the CEOs of Tencent and Baidu, Jia said, “We think the internet industry has already reached its peak. BAT and Apple have already peaked, and the next step is entering the internet ecosystem age.”

But in doing so, LeEco is venturing into markets that are by turns mature and ultra-competitive or nascent and unproven. With a growing brand reputation on one hand, and a multitude of challenges on the other, is LeEco ready to vault into the top tier of tech giants? Or will it come to be remembered more for its hubris? Underlining this challenge is the fact that, for all the impressive headline figures, many of LeEcoʼs subsidiaries are hemorrhaging money.

“There is a real shift,” says Thibaud Andre, a research associate at Daxue Consulting.“They have new branding, a new logo, they’ve changed everything. They’re not starting from scratch of course… but it’s a risk.”

Rights Move Founded in 2004 and listed on the Shenzhen stock exchange in 2010, LeEco initially made its name as an online video website—internet ranking firm Comscore ranked it the number one video website in China by unique visitors in December. And in contrast to many of its rivals, it has remained profitable, largely due to early efforts to buy content rights when they were still relatively cheap.

But the company’s content strategy has not just been about acquiring now costly rights—like many of its rivals, LeEco is attempting to save money and win viewers with original content creation. To that end, LeEco acquired award-winning TV production studio Flower TV for RMB 1.6 billion in October 2013, and the company also has LeVision Pictures, founded in 2011, a film studio engaging in US-China co-productions, including The Expendables 2.

Indeed, such ventures are essential to maintaining LeEco’s top position in China’s online video marketplace. “Chinese online users seem to focus more on content not platform and therefore when it comes to platform selection, viewer loyalty is relatively low,” says Chien-Hsun Lee, a senior industry analyst at MIC, a market intelligence and consulting firm in Taipei.

Not Content with Content

But what has really raised eyebrows is LeEco’s moves into hardware.

In 2013, LeEco launched its first line of Smart TVs, and according to the company’s annual report for 2015, it successfully hit its global sales target of 3 million units last year, powering much of the companyʼs impressive revenue growth.

Then in April 2015 LeEco debuted its smartphones, which are sold through its LeMall online store, as well as brick-and-mortar shops in major cities. Making clear its ambitions in this area, in July last year LeEco acquired an 18% stake in mobile device manufacturer Coolpad through its Hong Kong-based smartphone subsidiary for HK$2.73 billion, making it the secondlargest shareholder in Coolpad.

And in a sign of just who LeEco thinks they are competing with, the launch of their smartphones was accompanied by an anti-Apple campaign, one element of which controversially compared the Cupertino-based company to Adolf Hitler.

Jingwen Wang, an analyst at Canalys, notes that LeEco has already managed to emerge as an important smartphone vendor despite its newcomer status—although the company remained outside China’s top five vendors in of the first quarter of 2016. Despite that, the company themselves claimed that they have set new sales records with their handsets, reaching the one-million mark faster than its rivals.

This success is, at least in part, due to the company’s competitive pricing. Wang points out that “they are actually selling the devices below the phone cost, but actually they will be able to make a profit through the content.”

LeEco has further moved to round out its fledgling ecosystem with its range of smartbikes, competing with Baidu and one of Xiaomi’s start-up partners, and into the nascent field of virtual reality with its LeVR Cool 1 smartphone headset. And in addition to its hardware offerings, LeEco also has its LeMall e-commerce platform, the cloud computing and data processing service LeCloud (which recently received RMB 1 billion in series A funding), an online- to-offline wine selling website, and a stake in the car-hailing app Yidao Yongche.

While LeEco has enjoyed a banner year in 2015 financially, the same canʼt be said for many of its subsidiaries. Despite greatly increased revenues compared to 2014, losses have also accelerated. In the case of LeCloud, revenue jumped from RMB 130 million to RMB 562 million, while losses increased from RMB 33 million to RMB 100 million. Similarly, Leshi Zhixin, which amongst other things produces the companyʼs set top boxes, saw its losses hit RMB 730 million, an 89% increase on the year before.

And these losses come on top of concerns about how LeEco is financing its expansion—last year Jia used 85% of his shares in the company, equivalent to a one-third stake, as collateral for personal lines of credit that have then been used to fund the companyʼs various new ventures. Previously Jia extended interest-free loans to the company after selling over RMB 2 billion worth of shares.

Trading in the companyʼs shares has been suspended since December while the company incorporates its film business. But when trading resumes, any fall in the companyʼs share price could have severe implications for LeEcoʼs finances. Adding to the complexity are rumours around Jiaʼs connections to those caught up in Chinaʼs ongoing corruption crackdown.

Compounding the uncertainty is LeEcoʼs most far out venture: electric cars. Long shrouded in mystery, LeEcoʼs plans have become clearer with the debut of the LeSEE concept car. As with the companyʼs other hardware, the company plans to price the vehicle aggressively, and Jia has even gone as far as to suggest that one day the cars will be free.

Previously LeEco had developed an“Internet of the Vehicle” system, which was used as part of a collaboration with Aston Martin in the car maker’s Rapide S, released in January. Under a new memorandum of understanding between the two companies in February, the two companies will collaborate on the all-electric RapidE—featuring a LeEco battery and drive system—which is intended to rival Tesla by 2018. As incongruous as it might seem,

LeEco founder Jia has form in the field of electric vehicles—he was an early backer of Faraday Future, a Silicon Valley electric vehicle start-up that now plans to manufacture the LeSEE. While separate from the Aston Martin venture, three-way collaborations have not been ruled out. But no stone unturned: LeEco also invested in Atieva, another electric car venture.

But although ostensibly far removed LeEcoʼs other concerns, the company views it as another conduit for content. In an April interview with Reuters Jia said,“We consider the car a smart mobile device on four wheels, essentially no different to a cellphone or tablet.”

Smart World

For a company that has quickly amassed such seemingly disparate interests, the question naturally arises of how the different elements fit together.

“I would say to move into different industries, actually most of the devices are part of the smart home,” says Wang at Canalys. “It’s a way to increase user stickiness, to find more areas to make the business more profitable. If it focuses only on content, it has many competitors like large internet giants as well.”

That may provide the initial motivation for expansion and diversification, but once a move into different industries is underway, a whole new mindset is required. Lee notes that “LeEco used to focus on vertically integration of industry supply chains… Since the ecosystem now involves various ventures from different industries, it is no longer just about vertical integration.”

With rivals such as Apple using a combination of its iOS operating system, iPhones and Appstore to move into new sectors, it has become necessary for LeEco to do the same, lest it be left behind. “[It] is not hard to understand why LeEco has been trying to diversify its applications to include smartphones and virtual reality and automobiles,” says Lee.

Andre of Daxue Consulting also points to big data as being another driver behind LeEco’s expansion, harnessing the data it has, and expanding the data it can collect—motivations underlying LeCloud.

But such diversification isn’t without its drawbacks. Lee points out that such moves can adversely affect brand perception and positioning, and such a wide range of offerings can be of limited value if there aren’t proper synergies between the different industries and segments.

Further complicating the picture is LeEcoʼs rapid efforts to go global, both in operations and sales.

LeEco has adopted what it calls a ‘Beijing, Los Angeles, San Francisco’ (‘BLS’) strategy—the company has offices in both US cities, to which it added a new US headquarters in San Jose at the end of April. Under this rubric, Beijing stands in as the market for consumers, while LA and San Francisco are viewed as a factory for content and as a center for innovation and technology, respectively. While implying a continued focus on China, LeEco has also begun selling smart TVs and accessories in the US through LeMall, and in January LeEco began selling its products in India through Flipkart’s e-commerce platform, with more products expected to go on sale in June.

But seriously pursuing markets outside of China is no easy feat. “Going international is probably the main risk,” says Andre, noting they will be “competing with Samsung, with Apple, basically losing all the advantage of being in their domestic market.”

The other issue relates to what has hitherto been LeEco’s prime concern: content. “First, LeEco’s advantage lies on content and since most of content is in Chinese language, it is affecting the global expansion of LeEco,” says Lee. “Second, entering the overseas markets requires copyrighted content and CDN (content delivery network) construction and therefore LeEco is unable to speedily replicate in other markets its success in China.” And these issues come in addition to the competition in Western markets.

“LeEco is surely to face huge challenges when entering these local markets,” Lee continues. “Even if it wishes to replicate the bundled service with a low price plan, it still needs time to foster brand awareness, distribution channels and sales,” although Lee notes that LeEco has taken steps to engage with local content providers in other markets.

Race to the Finish

But for all LeEco’s grand ambitions, China will inevitably define its success or failure. There the company finds itself not only competing with well-established brands in various product segments, such as Huawei, but also companies with ecosystems of their own, varying from a top-tier brand such as Apple through to China’s other tech upstart, Xiaomi. And here the strengths and weaknesses of LeEco are the inverse of its competitors.

“Xiaomi and Apple have advantages in hardware and applications whereas LeEco has a large collection of copyrighted content and intellectual property resources. When it comes to building an ecosystem, it is always difficult to build up a large collection of IP resources correlated to high profit margins and therefore this has put LeEco at an advantage,” says Damien Chin, an industry analyst also at MIC. “Xiaomi and Apple have already had their own ecosystem built around their own-developed devices and the expansion to other services seems to be more effortless.”

And despite all the activity, LeEco still has some way to go. “In terms of performance and quality, I think they are pushing very hard, and that’s a point where we can say they are competing… they are very innovative,” says Andre. “But they are behind in terms of brand recognition, behind in terms of activity to integrate more with… additions to their ecosystem.” Andre also notes that LeEco thus far hasn’t matched Xiaomi’s activity in the world of start-ups.

As one of China’s top internet companies, LeEco won’t be going anywhere soon. But with the advantages in hardware manufacturing and just the current overall state of their ecosystem that the likes of Xiaomi enjoy, LeEco’s rush into so many segments begins to resemble not so much folly as sheer necessity lest the gap grow even larger. And with the company experiencing what Lee terms a “financial crisis,” due to the losses experienced by several of its subsidiaries, despite having received investments from the capital market, getting it right, and as soon as possible, becomes even more important.

With its ecosystem still in something of a nascent stage, it is hard to say quite where this enigmatic company will end up in China’s tech hierarchy, but with increased competition in its home field of online video, and ever more companies seeking to replicate an ecosystem model, the move from TV to Eco seems not only prudent, but also essential.