The Chinese economy is slowing and that has significant ramifications for things like capital and the Renminbi. Is there a silver lining in all this?

The release of China’s economic targets for 2015 during last week’s National People’s Congress meetings marks a turning point for the Chinese economy—GDP growth is likely to slow to a new low in decades while rounds of monetary easing haven’t been effective in increasing firms’ expansion activities.

The economic deceleration, combined with the expectation of rising interest rates in the US, are causing capital to leave Chinese borders and pressuring the Chinese currency to depreciate faster, which in turn raises costs for struggling Chinese companies.

While the economic hardship is set to last, the bright side is that China now has an opportunity to push forward economic reforms to make the structural changes it has promised since many years ago. “We always say that crisis is the mother of all reforms,” says Li Wei, Professor of Economics at Cheung Kong Graduate School of Business. “The slowing down makes us think that if we want to continue high growth, how can we get it done?”

In this interview with CKGSB Knowledge, Li shares his views on several questions about the Chinese economy and why the Chinese currency, the Renminbi, will remain relatively stable in the coming months.

Edited excerpts:

Q. Is 7% GDP growth a safe target?

A. It’s likely that the sustainable long run growth rate today in China is less than 7%. You can think about the target as more of an aspiration—and if we reach 6.9%, 6.8%, or even 6.5%—that’s pretty good growth. The slowing down has to do with the fact that resources at the disposal of the Chinese economy—the most important being labor—are no longer growing at a fast pace. We used to rely on workers to migrate from rural areas to the urban, manufacturing-based economy [for growth], but today if you go to the countryside, you’ll find that there’re not so many young people left anymore.

And it’s okay for China to grow at a lower pace. In the past, the talk about 8% as being a very important growth rate, below which [there] will be socially [instability], rested on the premise that China cannot generate sufficient number of jobs to absorb high school and college graduates, [whose volume] is expected to grow every year. I think we’ve reached the point where the number of high school and college graduates is beginning to decline, as the Chinese population moves into the phase where we’re going to see fewer and fewer younger people going into the workforce. So today the job creation pressure is off.

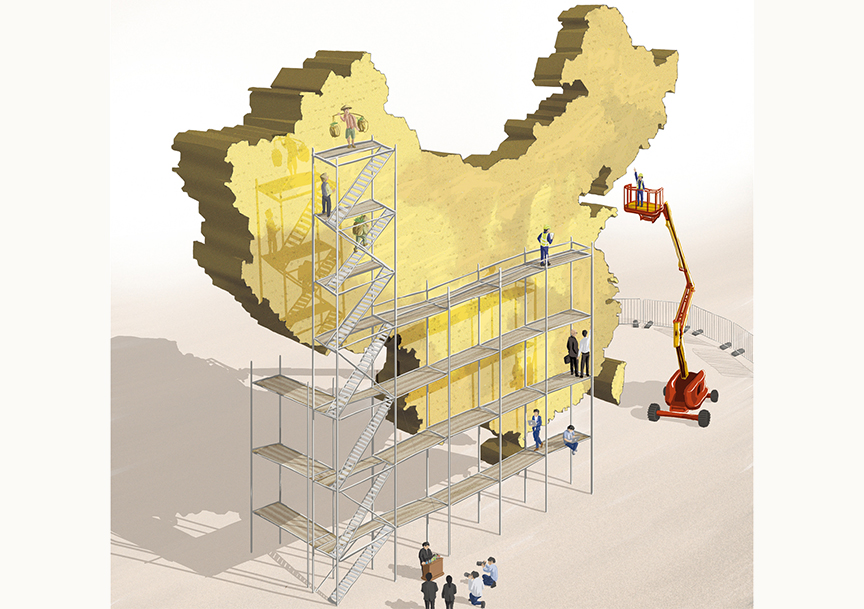

Q. Why is now a window for structural changes?

A. When you have growth that is so robust for so long, you begin to think why there’s additional need for more reform? You have vested interests, who are very comfortable with where they are at the moment.

That impasse can only be broken down if the economy slows down. We always say that crisis is the mother of all reforms—I’m not saying that we’re in a crisis situation yet, but the slowing down makes us think that if we want to continue high growth, how can we get it done? We can’t have more workers, we have been investing as heavily as any country has ever done in history, so what are the sources of growth?

The only source of growth is the increase of productivity. For every dollar of capital we put down, for every person we employ—they have to produce more. There have to be structural changes in the economy, there have to be conditions where individual initiatives are very valuable and people will be encouraged to make something—to have that maker mentality. Ideally we’d like to get there voluntarily, but there are political forces and social inertia that prevent deep structural changes.

Q. Is China facing deflationary pressures?

A. China’s inflation is at a historical low, and the forecast is very clear that it won’t rise up substantially, even if we have more stimulus policies on the monetary side. It partly has to do with the fact that most industries in China today have overcapacity; as a result, we’ve seen that the producer prices have been falling and the consumer price index has been stable.

In the coming years we could even see a lower target for inflation, between 2% and 2.5%, a level that most developed countries are targeting. Recently PBOC lowered benchmark interest rates because as the inflation expectation is falling down, interest rates should just fall down in locked step. Therefore when some commentators estimated that the stock market is going to see a boom [because of the monetary easing], my reading was that it’s just business as normal.

Q. Is capital flight dangerous for China?

A. If I were a central bank official, I wouldn’t be too concerned… because this is a natural part of investors rebalancing their portfolio. The good thing about it is that it reduces China’s foreign exchange reserves. Today it stands at $3.7 trillion—I would say that is unheard of in the history of human economic activity.

It’s not efficient for a central bank to hold so much foreign exchange reserve because that increases China’s money supply significantly. So China’s central bank has to lock in much of the new money through applying very high required reserve ratio on banks. It creates incentives for the banks to say, “Attracting deposits is very costly for me, and as a result, I’d like to move my assets and liabilities off my balance sheet.” That’s the reason why in the last five or six years we have seen a rapid growth of shadow banks. They grow because China has so much foreign exchange reserve.

Q. Will the RMB depreciation accelerate?

A. In the past years we’ve seen large movement of capital into China and some of it comes in the form of debt investment. Doing so is profitable because the return is higher [than in developed markets] and also there’s a calculation that the RMB is going to appreciate.

If China were to let the yuan depreciate significantly, many of these investments will go bankrupt. And if we look at who are actually doing all this currency arbitrage—it’s likely large state-owned firms, because they have the capacity to borrow dollars in the international markets. And, of course, they have political clout So my prediction is that even though overall it might be good for China to let the RMB depreciate at a faster pace, but politically, maintaining the relative stability of the RMB is important. At least in the next few months, the currency is going to be volatile but relatively stable, trading within a narrow range.

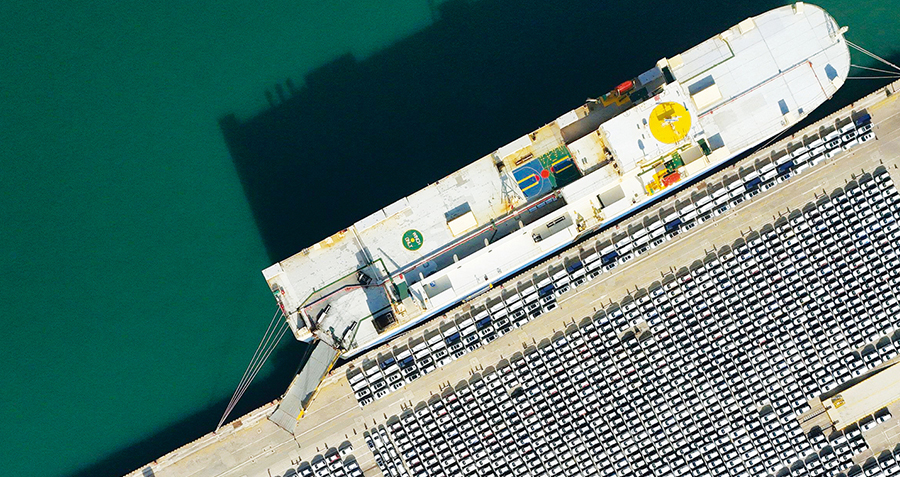

Q. How do lower energy prices influence Chinese exports?

A. Starting around 2005, China has suffered a deterioration in its terms of trade. The simple way to think about terms of trade is to compare export prices to import prices. The deterioration of terms of trade means that export prices divided by import prices is actually falling. In other words, the more China exports, the Chinese exporters will find that competition drives down their export prices; and as they manufacture more goods, they are going to import more materials and energy, thus driving up commodity prices.

Today we’re seeing a reverse of that—export prices have stayed roughly unchanged in dollar terms, but import prices have fallen significantly. So China today is seeing an improvement of terms of trade, which is very beneficial, in general, to the Chinese economy.