Can the traditional TV broadcaster successfully play ball in China’s digital content market?

Looking around on the metro in any of China’s big cities, it seems every single person is completely immersed in their cell phone screen, tapping for news reports, scrolling through online forums, playing games, catching up on soaps. From kids to grandparents, everyone is online, up-to-date and constantly consuming content on the move. It’s a lucrative market for content providers, and attractive enough for satellite TV company Phoenix TV, one of the only ‘independent’ and non-mainland broadcasters with permission to land in mainland China, to boldly reincarnate as a digital media company with the listing of its corporate digital spin-off, Phoenix New Media, in 2011. The young digital media entity has a lot going for it, but it faces significant challenges from internet-dominating rivals and fickle audiences.

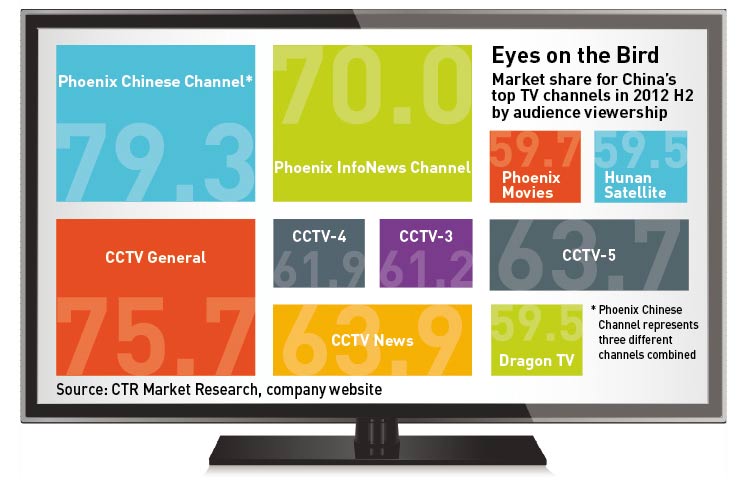

The digital media landscape in China is already heaving. Big internet portal companies like Sina, Tencent and Sohu have the experience to deliver huge amounts of video content on demand, and have led the field for quite some time now. Indeed, Phoenix New Media is a relative newcomer on the scene, but it hit the ground running back in 2011 when Hong Kong-based Phoenix Satellite Television Holdings created the corporate spin-off and filed its IPO in the US the same year. Phoenix New Media has several strong suits: the long heritage of its independent, parent TV company, the ability to share its quality video content across all its platforms, and a partnership with China Unicom for mobile video. But moving from a slower-paced TV company to being a responsive, agile digital provider can often be tricky, indeed a move that China’s major national broadcasters, like state-owned CCTV, haven’t even begun to master.

“CCTV should be dominant online but has not even made the first successful moves in that direction,” says Peter M. Herford, former Professor of Journalism at Shantou University and former Vice-President of the CBS news division. “They too are concerned with stealing viewers and listeners away from their traditional broadcast channels. CCTV’s challenge is that the decision of how and when to move more aggressively online is out of their hands. These are political decisions.”

Investor’s Darling

Parent company Phoenix Satellite Television was founded by Liu Changle in 1996 and now has six TV channels. Headquartered in Hong Kong, it is one of the few private broadcasters allowed to broadcast in Mainland China, but with a key caveat: Phoenix TV belongs to a category of broadcasters that need special permission to land on the mainland, joined by BBC, HBO and CNN. Similarly, hotels, offices or high-end residential compounds have to apply for the satellite transmission of these channels. This kind of regulation has more or less been circumvented by average Chinese through illegal satellite TV and digital TV. That reality does keep Phoenix TV viewership somewhat skewed to the higher end demographic, but as internet-based TV products like Xiaomi’s IPTV box become more accessible in terms of distribution and price, that will also change.

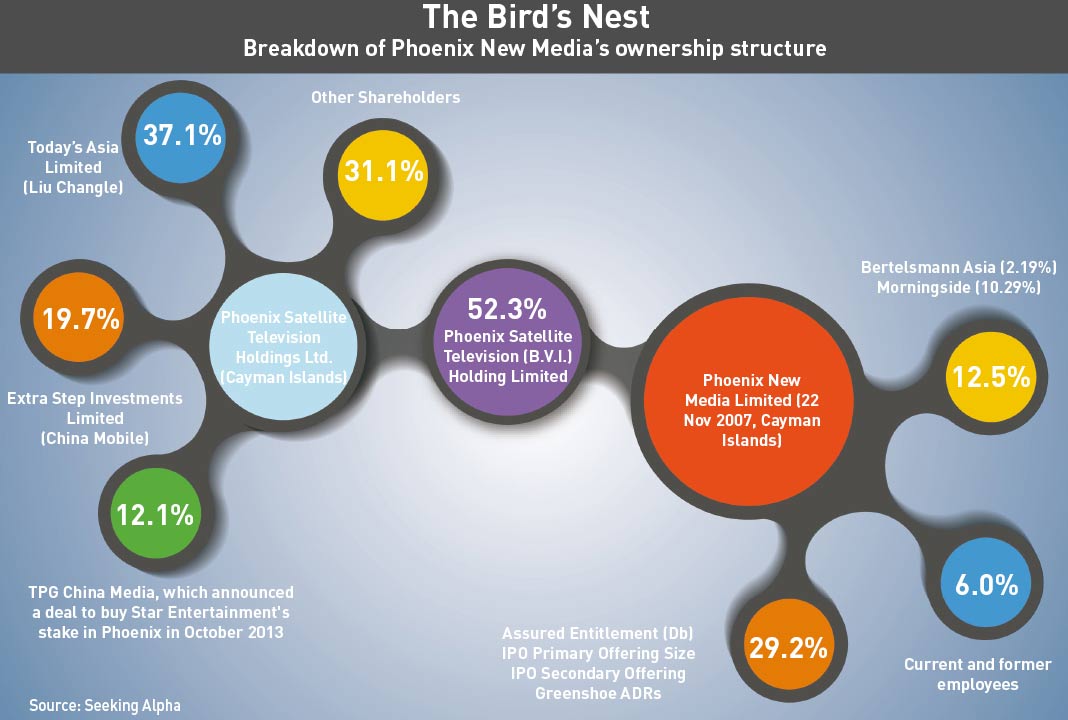

The expansion of internet-based TV will also factor into the future of Phoenix New Media, which did not respond interview requests, is currently comprised of a website (ifeng.com), a video channel and a mobile channel in partnership with China Unicom. According to web metrics firm Alexa Internet, a US-based company that collects and analyzes internet traffic data on around 30 million websites globally, ifeng.com ranked thirteenth in February 2014 in terms of daily page views among all websites in China. The company received $25 million worth of investment from Morningside Ventures, Intel Capital and Bertelsmann Asia Investments Fund in 2009, before it was listed on the New York Stock Exchange in 2011. Its 2012 revenue reached $1.1 billion. In the third quarter of 2013, total revenues increased by 32.3% year-on-year, reaching RMB 378.7 million ($61.9 million), according to company reports.

Phoenix New Media stands out in China as one of, if not the only move by a traditional broadcaster to takeover digital media via a corporate spin-off. Two years after their IPO launch, Phoenix remains a favorite among investors, even after Rupert Murdoch sold his majority stake in the parent company, Phoenix TV, in 2011.

“I believe ifeng [FENG.NYSE] remains hot because of its differentiation from its peer portals in China,” says Xiaoyong Guo, a strategic equity research analyst at Pacific Asset Management Company in Shanghai. “Firstly, it’s an online media portal managed by a TV station, and you will not find a similar structure in other listed media companies in China.”

Phoenix New Media’s revenue growth in 2013 was mainly driven by a 59.3% increase in net advertising revenues from ads appearing on its online platform.

“Online ad revenue is expanding fast in China and, as more advertisers target internet users, online monetization accelerates, so investors have higher expectation for mobile video, which is likely to generate high ad income in the future. Plus, compared with peer portals, Phoenix New Media has special content (news, video, TV programs and bullet board systems) which could be considered as a competitive advantage for the company,” says Guo.

Phoenix TV can effectively play both on one hand close ties to the government, which will ensure it gets all the necessary licenses and approvals, while simultaneously retaining a degree of independence. Audiences are hungry for information that doesn’t come from CCTV and other state-run channels, which is where Phoenix can appear authentic and apart.

So Seductive

Phoenix New Media is an attractive option for advertisers as well as investors. More and more advertisers are directing their marketing budgets into digital channels, and CEO Liu Changle has stated that Phoenix New Media is central to the group as a whole, because of the advertising revenue it can generate.

“Phoenix was smart to create a separate entity and avoid the trap that many organizations fell into earlier in the development of online content. The trap was to load the online challenge on top of the existing platform without a separate organization and structure,” says Herford. “CBS was no different. Broadcast audiences are ageing and dying. Advertisers want the 18-35 year olds and the only source for them is mobile and online,” he adds.

CCTV Online, the digital arm of China’s state-owned broadcaster, would seem like a natural rival of Phoenix New Media in theory. In terms of size, it dwarfs the young ifeng.com. Yet there are some key differences that give Phoenix New Media the edge.

“There is no transparency to the CCTV operation,” Herford says. “Not that Phoenix is wholly transparent, but Phoenix with a base in Hong Kong and some arms on the mainland is a ‘.com’ as opposed to what the US would call a ‘.gov’ operation. In that sense the two operations could not be more different. They serve different masters.”

Furthermore, Phoenix New Media’s traditional broadcasting background affords it the clout to engineer ventures like the China Unicom mobile partnership. China Unicom’s appeal relates to its relatively successful rollout of the international standard for 3G, in addition to its status as the second-largest telecoms operator in China, with the state as its biggest shareholder.

“This raised Unicom’s profile significantly,” says Lydia Bi, a research analyst at Canalys, a global market research firm in the IT industry.

Shan Chengjun, China Broadcast & Analysis Director at Asia-Pacific media intelligence company iSentia, says that compared with independent portals, Phoenix New Media can easily attract followers who are already an audience of different channels under Phoenix TV.

“The brand image, nature and features of Phoenix TV are naturally inherited by Phoenix New Media, or at least so perceived by its existing and potential audience,” says Shan. “You are not coming from nowhere, so you are not building something from nothing.”

Paradoxically, he believes that its biggest asset—the parent company’s heritage—could also be a hindrance for Phoenix New Media, as the online audience may consider it just an extension of the TV channels and think it has nothing additional to offer on its digital and mobile platforms.

Identity Crisis

Many believe that Phoenix New Media won’t be able to really compete with the likes of search engine leader Baidu and online video platforms like Sohu and Youku Tudou because ifeng.com is not a portal and doesn’t have the sheer pulling power and variety of their competitors.

“Their challenge is: what can we offer that is different from the well established Sohu and Youku Tudou, or ideally what can we offer that they cannot?” says Herford.

While Phoenix may be able to be more cost-effective by sharing content across their platforms, Herford believes that viewing an online arm as a money-saving enterprise is a dangerous approach, not least because different skill-sets are needed, and broadcast news staff may not take kindly to having online requirements added to their duties, like online ad sales.

“The target audience of Phoenix New Media, young and middle-aged white collars, could be a special attraction to certain advertisers,” says Shan. “Online media can present advertisements in many different innovative formats, some of which can even directly lead to sales by linking up the advertisement to an order placing function. Even if a deal is not made, advertisers can still learn how many people are truly interested in their products by factors such as the click-through rates, which can be used as market intelligence for future product development or marketing campaigns.”

Political Baggage

Making the move from TV to the highly competitive digital world will present some ongoing challenges for Phoenix New Media. The privately owned parent company has very close ties with the government—Liu Changle has been on three standing committees—which could impact its image with investors, particularly those in the US who are more attuned to the government ties of companies from the greater China region.

Herford says that while foreign companies may want to invest in China-based media companies, they should consider restrictions on their investment. “Could a foreign broadcaster, one of the American or European networks, could they participate as content providers? Not likely from a political point of view. This will not reduce the foreign investment interest, but it may cripple its ability to participate.”

The government-controlled business environment can challenge foreign investors, like Rupert Murdoch for one, whose News Corp announced in Spring 2013 that it would sell off a 5.28% stake in Phoenix TV (reducing its stake to 12.16%), then announced its final departure from China’s TV market when it said last October that it had sold its remaining stake in the company to a US private equity firm.

Murdoch said in 2005 that his business in China “hit a brick wall” after the government tightened restrictions on foreign media companies and his son, James Murdoch, the CEO of 21st Century Fox, said in an interview with Fortune this year, “It’s always been hard for us in the business of ideas to do business in China. That’s clear and a lot of people have those issues.”

Potential investor trust issues aside, historically it has always been a challenge for large, well-established traditional media agencies to show the necessary agility to adapt to the mobile/internet world. Phoenix New Media also has its work cut out to demonstrate that traditional broadcasters can successfully make the leap.

“Years ago Shanghai Media Group was given the first license to do online broadcasting. There was a great deal of publicity and anticipation but the results thus far have been meager,” says Herford. “Southern Weekend (a newspaper based in the southern province of Guangdong) had aggressive plans for a full-time video channel and quickly discovered that the costs and demands of programming a 24/7 online channel were far greater than they imagined. The pressures of political considerations and partnering with a traditional media group have proved to be too much to let the concept flourish.”

“Phoenix has deep pockets, that’s a big advantage. They will be able to spend money to make this work, and it is expensive. But the fact is in this day and age they have no choice. Traditional broadcasting does not have a healthy long-term future. Everything, not just news, is headed for a digital online future delivered wirelessly.”