As consumers drift towards easy-to-use internet finance in China, what will happen to traditional banks?

Like many businesses the world over, investment in China has gone mobile. Just ask Yang Ren Jun, a 26-year-old translator and interpreter in Shanghai. Yang initially invested RMB 3,000 in a new online investment service called Yu’e Bao (meaning “leftover treasure” in Chinese) in February this year, following the product’s launch in June of last year. Her husband invested several tens of thousands of RMB. Yang now uses a mobile app to check the account regularly, eyeing the steady growth of her bundle as the annual interest rate of roughly 5% does its work.

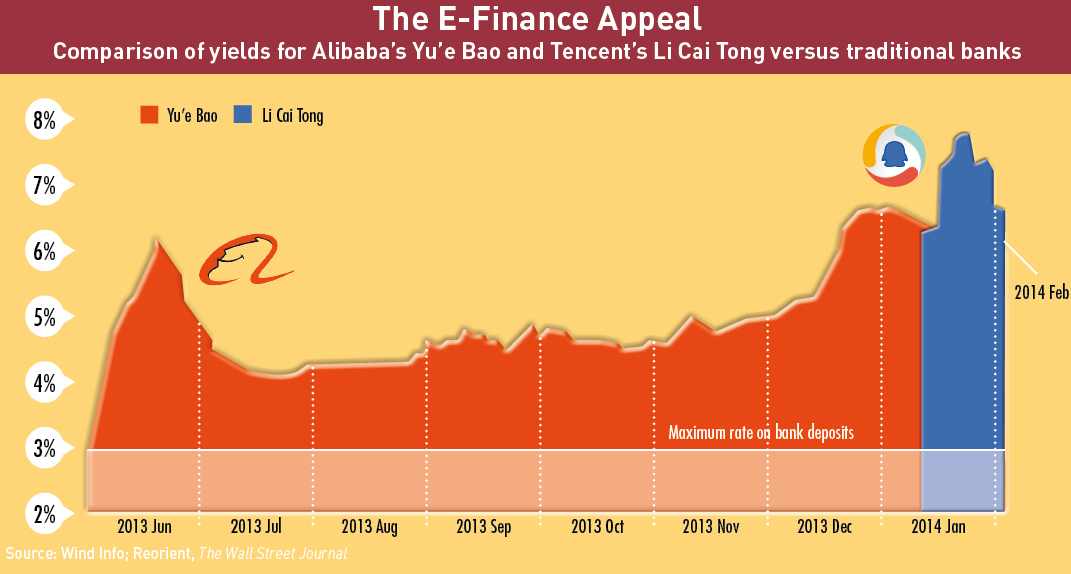

“The interest rates are much higher than bank interest rates (See The E-Finance Appeal below), and you can make transfers and pay utility bills. It has a lot of functionality,” says Yang.

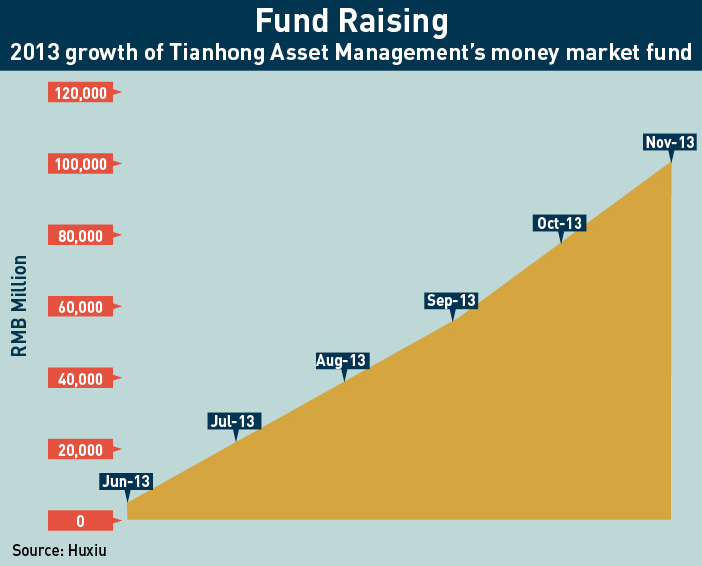

Yu’e Bao has catapulted Alipay, an online payment company that provides the product, and its affiliate Alibaba, China’s largest e-commerce company, to the forefront of the financial industry. Long known for a thriving e-commerce business, the sprawling Alibaba empire now also lays claim to one of the largest, most heavily capitalized mutual funds in the world. Alipay attracts the funds for Yu’e Bao, and then turns them over to Tianhong Asset Management Co, now 51% owned by Alibaba, to invest. After launching last June, Yu’e Bao had reported amassing roughly RMB 400 billion ($65 billion) in assets under management by mid-February, making it the largest money market fund in China and among the largest in the world.

Not to be outdone, China’s other major technology companies are quickly launching competing products. Tencent, a software and gaming company, has introduced a product that allows users of its popular WeChat mobile chatting app to put money directly into a fund run by China’s largest mutual-fund manager, China Asset Management. Sina, which runs the Twitter-like service Weibo, and Baidu, the company that operates China’s largest search engine, have released similar products in partnership with fund companies, and other internet companies as well as traditional banks are also eyeing the sector.

Due to their broad appeal and accessibility, these online investment platforms are changing the way consumers access financial products in China, tapping a much broader and deeper market. In the process, they are opening new business possibilities for technology companies, which are seeing their numbers of users and their access to bank accounts boom. They are changing the game for traditional banks, which must compete for funding and customers for the first time. They are also creating new challenges for regulators, who must make sure that China’s economic stability isn’t sacrificed in the rush toward growth and innovation.

The rapid growth of the online investment market is the product of a “perfect storm” in China, says Zennon Kapron, Managing Director of financial consultancy Kapronasia. China has a large and secluded financial market in which many middle class people lack access to investment opportunities, and a liberalizing but still very traditional financial sector, he says. It also has a vibrant technology sector that is uniquely positioned to bridge this gap.

A People’s Bank of China

Yang and her husband demonstrate one of the most compelling aspects of Yu’e Bao and its competing products: their appeal to Chinese across categories, from those who earn a few thousand renminbi a month to those who earn more than a million renminbi a year.

That’s in part because these online services are so easy to use and access. Most users manage their funds through their smartphones. Funds can be withdrawn or transferred nearly instantaneously and at any time of day, not just business hours—meaning customers no longer have to put up with the long lines for which Chinese banks are infamous. The platforms also have high withdrawal limits and no minimum investment requirement—Yu’e Bao users can invest anywhere between RMB 1 and RMB 1 million, as opposed to the RMB 1,000 ($165) minimum for many investment products at traditional banks.

Funds in Yu’e Bao can be used for payment at any place that accepts Alipay, China’s largest third-party online payment provider. And users of these services can also expect a higher return than that offered by traditional savings accounts. At around 6% and up, the returns from online investment platforms are more akin to those from China’s new generation of wealth management products. Alibaba’s Yu’e Bao says it generates these returns by investing in products including cash, short-term commercial papers, bank deposits, short-term bonds, central bank notes, bonds, asset-backed securities, and money market funds.

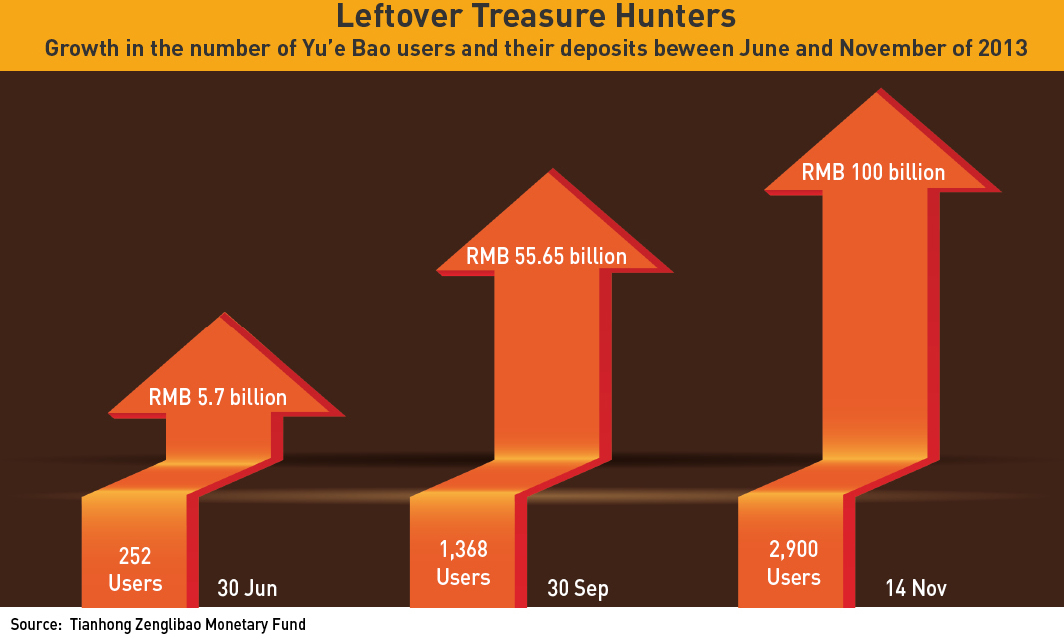

Typical users of these services vary widely, but many are young and tech savvy enough to be more comfortable with banking through their phones than queuing at the bank. According to Alipay, the average age of Yu’e Bao’s 49 million users is 28, though the age with the largest number of investors overall is 23.

Yet analysts caution that a surprising swathe of customers for online investment platforms do not fit this profile. Smartphone penetration is providing access to online services to people of all ages and demographic groups. Unlike in developed countries, many Chinese are skipping computers altogether and accessing internet for the first time through their phones, a process often described as “leapfrogging”. And China’s e-commerce industry is not strictly an urban phenomenon—in the country’s vast and underdeveloped interior, e-commerce has taken off as a way for rural residents to access coveted products.

“Digital penetration is happening faster than people would imagine in China,” says Zhang Yue, a project leader at Boston Consulting Group in Shanghai. “More and more elderly people are getting used to digital channels—even my mother-in-law [uses] online banking and WeChat.”

In a country where access to funding is typically limited to well-connected and well-established people and businesses, the rise of online investment platforms is giving a wider swathe of Chinese society access to the financial system. The much lower cost of operating a digital platform means that internet companies can afford to provide investment services to consumers that banks have previously ignored, like those of lower income brackets or in rural areas.

“It meets a huge unmet need,” says Zhang. “Banks don’t have a reasonable business model to serve this type of people because the costs are very high.”

The Next Gold Mine?

For China’s technology companies, online investment platforms represent a significant source of new business—especially for the market leader, Alibaba. As of January 15, Yu’e Bao had 49 million customers—more than the population of Argentina (See Leftover Treasure Hunters below).

Rivals like Tencent, Baidu, Sina and others are hoping to follow closely on Alibaba’s heels. In courting this new market, companies appear to be sticking to their competitive advantages, whether their specialty is e-commerce, online search or social networking.

Compared with other internet companies, Alibaba was well positioned to offer financial services; in addition to operating one of the world’s largest e-commerce platforms, the company has a successful online payment tool, Alipay, and a small business lending division. Last year, the total volume of merchandise handled by Taobao and Tmall, Alibaba’s two main shopping sites, topped one trillion yuan ($160 billion), more than the total for Amazon and eBay combined.

Many Alipay users took naturally to the Yu’e Bao product as a way to make some profit off the funds that were already sitting in the accounts they use to make purchases from Taobao and Tmall. As the fund grew, many began moving their entire savings into the product.

Inspired by Alibaba’s success, Tencent joined the market in January 2014 with an investment platform, Li Cai Tong, which was designed to capitalize on the company’s expertise in social networking. The product allowed users of Tencent’s WeChat mobile application to transfer money directly to a fund run by China Asset Management. In a bid to attract users, the fund offered an initial seven-day annualized yield of 7.3940%.

WeChat has more than 600 million users, equivalent to half of China’s population, but few had linked WeChat with their bank account. But since Li Cai Tong’s launch, Tencent has made progress in this regard. The company launched a successful promotion for Chinese New Year that allowed WeChat users to send each other “red packets”, a digital version of the envelopes of cash that are traditionally exchanged during the holiday. The promotion succeeded in prompting many new people to connect their bank accounts to the Tencent platform—connectivity that gives the company the ability to launch a greater variety of profitable products in the future.

Baidu, the operator of China’s largest search engine, took a different strategy in launching its four current investment products by initially emphasizing partnerships with traditional banks. Kaiser Kuo, Director of International Communications at Baidu, acknowledges that Baidu began with a smaller base of applicable customers than Alibaba, but describes the ventures as part of a longer-term strategy aimed at building up Baidu’s payment platform. In March, however, Baidu CEO Robin Li announced that the company had formed a partnership to apply for a private banking license, which would allow it to manage investments directly.

The Bottom Line

For all of the major providers, online investment services appear to be more directed at attracting users to their payment platforms than generating profits, at least initially. Though none of these companies publish data on costs and revenues for these services, analysts speculate that online investment platforms are generating only slim earnings, if they are profitable at all.

According to Junheng Li, the founder of equity research firm JL Warren Capital, Alipay charges its depositors a slender 0.33% asset management fee, much lower than the average 0.5-1.5% fee charged by US mutual funds and the 1.2-1.5% fees charged by Chinese mutual funds. Alipay’s service also offers a floating, rather than fixed, rate of return, indicating the company is passing most of the gains from their funds on to customers, says Li.

Zhang of Boston Consulting Group estimates that Baidu, which regularly offers an 8% return on its products, is likely collecting an even smaller return. “You can’t earn money with that [high of a] guaranteed return,” she says. “Probably Baidu is also taking money out of their own pocket to give to the customer.” Both companies allow users to make near-instantaneous withdrawals from their funds, meaning they have to hold a large pool of cash on hand—a costly practice in terms of forgone investment profits.

Even so, it may be worth it for China’s technology companies to absorb some losses now in order to build more effective payment platforms for the future. Li says internet companies are trying to adapt quickly to sustain profits, since many of their old revenue sources are drying up. “All internet companies in China have realized that the traditional models such as gaming and advertising have passed their tipping point,” she says. And because payment platforms are crucial in determining whether a company can monetize internet and mobile services, they will likely play a prominent role in determining the fate of internet companies over the next decade.

Kuo of Baidu seconds this idea. “Online payments are a very vital piece to any kind of consumer-facing ecosystem,” he says. Baidu’s search platform has traditionally catered to business clients, but the company is gradually shifting toward more consumer-oriented businesses. “Obviously one key piece to that has to be the ability to take payment from them,” he says. “And [online investment platforms are] a good way to ramp up the numbers of people that we’ve got.”

Now may be an opportune time for trial and error: the regulatory environment for online investment products is still relatively lax, and new customers are plentiful. But the market will not remain rarified forever. Even as technology companies ramp up their services, new internet companies and traditional banks are jumping into the fray. (To read more about the issues surrounding regulating internet finance in China, click here.)

Old School vs. New School

The rise of these tech savvy competitors is putting stress on China’s traditional banking system. As online investment products expand, they absorb some of the funds that would have flowed into bank deposits (See Fund Raising below). In a blog post in February, an executive editor of CCTV even called Alibaba’s Yu’e Bao product a “vampire” that is sucking the life out of Chinese banks.

Some traditional banks are trying to respond by evolving their own competing online services. Zhang Yue of Boston Consulting Group has been leading workshops to train banks on how to adapt to the digital age and introduce competitive online products. She says it is often a challenge for banks to be flexible and creative enough to compete with the likes Alibaba, Tencent and Baidu—companies that have built empires on their ability to quickly roll out innovative digital products. Yu’e Bao, for example, took only six months to develop, from product design to launch.

“There is a huge clash of culture—banks are risk-averse, conservative and slow. A digital firm or an internet firm is just the opposite,” says Zhang. “It’s very difficult to ask a banker to act and think like someone in an internet firm, but if you want to compete in that space with those internet firms, you’ve got to understand that culture,” she says.

If banks don’t find ways to compete, they risk losing some of the funding that China’s tightly controlled financial system has traditionally channeled to them.

China’s still underdeveloped financial system has offered few options for investment beyond savings accounts and real estate, and regulations have set a ceiling on the interest rates that banks can offer their depositors. That means that banks have had a plentiful source of cheap financing, while average Chinese have been paid little in return for their savings. This fixed interest rate system has given banks near-guaranteed profits, making Chinese banks among the most profitable in the world, says Kapron of Kapronasia.

In the last few years, however, forces from inside and outside the official banking system have begun gradually remaking these rules. Arbitrage between the traditional banking sector and China’s ballooning shadow banking sector, in which companies and individuals that cannot get loans from traditional banks can access capital at much higher interest rates, is gradually pushing up overall interest rates. Meanwhile, the Chinese government is also relaxing its rules step-by-step, allowing market forces to play a greater role in setting the cost of capital.

For example, regulators began allowing banks to buy and sell negotiable certificates of deposit at market-determined rates in the interbank market in December. The government has also allowed the market for wealth management products (WMPs)—bank-generated investment products that typically offer returns of between 5-7%—to bloom in recent years. Ratings agency Fitch estimated that China had roughly RMB 13 trillion ($2.13 trillion) of WMPs outstanding by the end of 2012—up 50% from the previous year.

This growing competition for capital has forced four of the country’s five largest banks to raise rates on one-year fixed deposits to 3.3%, the highest return allowed by central bank regulations, Chinese media reported in January. Most analysts see these developments as steps in a long process toward the full marketization of China’s interest rates.

“Banks are facing a challenging 2014, because the road to the marketization of interest rates has already started,” says Kapron. “Within three to five years, interest rates will be liberalized in China—at least more liberalized than they are now, and hopefully fully liberalized… That coupled with an eroding deposit base is challenging for banks.”

Yet some analysts say that online investment services are not yet having much of an effect on the banking system because they are still much smaller than banks. Junheng Li of JL Warren Capital compares Yu’e Bao’s roughly RMB 400 billion ($66 billion) in deposits in mid-February to the around RMB 145 trillion ($23.8 trillion) in total banking assets China had as of the end of June. “So the total is still very small, even though these products are growing like weeds,” Li says.

Jim Antos, a banking analyst at Mizuho Securities, agrees. Yu’e Bao’s balance sheet sounds like a lot, he says, “until you check ICBC’s balance sheet. By itself, ICBC has RMB14.69 trillion ($2.41 trillion) in deposits.”

If they keep expanding, however, these funds will eventually start impacting traditional bank business. According to Zhang of Boston Consulting Group, some estimates put the potential size of the online investment market at roughly RMB 2 trillion ($328 billion). China’s online investment platforms still have a large scope for attracting and investing money—but their potential is not unlimited.

Running the Risk

As consumers become more educated about how to find the best return for their money and online investment funds begin to approach the limits of their market, some funds could face an increasing risk of default. Zhang of Boston Consulting Group points out that companies like Alipay and Tianhong Asset Management have no prior experience managing such massive funds. Security is an additional challenge for online funds, which like all internet services are vulnerable to the theft of personal information.

“If they really reached their limit of their management capabilities for such a large product, [and] they could not guarantee the return or their technology has a problem, then it could be a disaster for investors,” said Zhang.

Recent defaults of WMP products—like the high-profile default in late January of a fund marketed by ICBC—have heightened concerns about these investments. Yet many Chinese consumers do not seem very aware of the potential risks with online investment products. As the market gets increasingly saturated and online companies compete to attract users with ever-higher yields, the risk of default may grow. Online companies may be padding customer returns from their own pockets, but they do not explicitly guarantee them; if defaults were to occur, it’s unclear who would ultimately pay the bill.

“While consumers clearly understand and appreciate the high returns available from internet-based investment, there is less awareness of what might go wrong, as we have yet to see a default from these companies,” says Antos of Mizuho Securities. But this could change if an online investment product were to default.

Regulators appear to be watching the sector carefully. Media reports in late February said that China’s central bank is leading a government effort to develop regulations specifically for online investment products. In March, Li Keqiang said that the government intended to support online financing but would also keep a close watch on the sector.

The extent of the government’s regulations may offer some clues as to how quickly Beijing plans to loosen its restrictions on the traditional banking system. By letting market forces play a more prominent role, regulators could deliver access to funding to many ordinary Chinese and smaller companies, likely helping to foster a new source of growth that China can draw on for decades.

Yet so many new users gravitating to these higher interest rate products could also pose a challenge to the traditional banking system in years to come, perhaps endangering economic growth in the process. As the lever that China uses to inject money into the system, the banking system plays a critical role in ensuring China’s economic growth. Regulators will have to strike a careful balance between encouraging the sector’s development and working to minimize risk.

Zhang suggests one way that the industry might reduce these risks: by emphasizing partnerships between banks and technology companies, instead of cut-throat competition. Instead of fighting to introduce higher rates that make lending unprofitable and put solvency at risk, banks and technology companies should take advantage of each other’s strengths: the tech sector’s ability to innovate and access new customers, and the banking industry’s long history of fund management. (To read more about the risks associated with internet finance in China, click here.)

For their part, consumers should take advantage of new investment opportunities, but be aware that the new era of market-determined financing brings substantially different risks than China’s old order, Zhang says. “We would recommend customers with a very old saying: Where there is a return, there is a risk.”