PC-manufacturer Lenovo is gearing up for the era of tablets and smartphones with an improved business model

When the iPad 2 was launched in 2011, late Apple CEO Steve Jobs declared the years to follow as the “post-PC era”. Thanks to abysmal PC shipment numbers since, an army of tech bloggers have followed in suit declaring: “PCs are dead!”

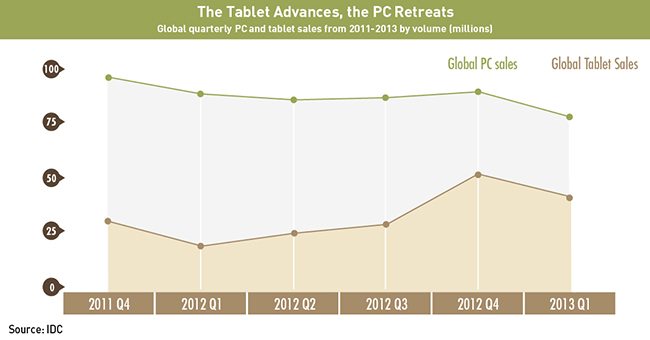

True, according to the most recent global PC tracker data from the International Data Corporation (IDC), traditional PCs are at least in terminal condition. In the first quarter of 2013, global PC sales totaled 76.3 million units, a decrease of 13.9% compared to the same quarter in 2012. The year-on-year contraction stands as the worst quarter since IDC began tracking the PC market in 1994. IDC Research Director David Daoud characterized the scale of the contraction as “surprising and worrisome”. Two months later, in May, IDC revised its forecast of global PC shipments and now predicts the market will contract by -7.8% in 2013, darker than its March estimate of -1.3%. Similarly bleak figures from Hewlett-Packard (HP) and Dell indicate the two ailing PC makers would concur.

But one PC maker is robust despite the doom and gloom.

Chinaʼs Lenovo Group is gearing up for what it refers to as the ʻPC plusʼ era, a period where consumers use non-traditional personal computing devices such as tablet computers and smartphones to meet their day-to-day computing needs. Major PC manufacturers HP and Dell are struggling to cope with these changes as tablet sales eat into their PC-related product lines. By comparison, rather than refocusing its attention away to solely support new product categories like tablet computers and smartphones, Lenovo has continued to support and innovate its traditional line of PC computers.

“Lenovo, until quite recently, has been very focused on the PC era. Lenovo approaches its PC business group and mobile business group as two separate businesses, and I think this has allowed them to grab more market share,” says Teng Bingsheng, Associate Professor of Strategic Management and Associate Dean of CKGSBʼs European Campus.

This line of thinking holds true, and Lenovo CEO Yang Yuanqing went on the record saying, “We donʼt live in a post-PC world,” in an interview with Reuters in January. “We are entering the PC plus era,” he added. Yang said it is a post-PC world for one group: companies that do not innovate in PCs. “In our industry many players think PCs have become a commodity product,” he said. “We have never thought this way.”

Yangʼs accusal of other players have so far proven accurate, underlining how his company is embracing the ʻPC plus eraʼ, which can be described as an era where PC makers should innovate in their PC lines, in addition to recognizing the computer marketʼs seismic shift toward tablets and smartphones.

Shipments of tablet PCs—ultra-portable devices that utilize touchscreen input or a pen-enabled interface—are expected to reach more than 240 million units worldwide in 2013, easily exceeding the 207 million notebook PCs that are projected to ship, according to NPD DisplaySearch Quarterly Mobile PC Shipment and Forecast Report. Tablet PC shipments will for the first time ever secure more than 50% of the annual market share. PC companies that have come late to the game are paying the price.

HP and Dell are far and away the two biggest losers in PC sales, whose global shipments dropped 23.7% and 10.9% from the first quarter last year respectively, according to IDC figures. Corporate issues at both companies may have contributed to the decline: HPʼs attempts at internal restructuring are negatively impacting commercial sales, and Dell is in the process of buying the company back from shareholders while simultaneously transitioning its business model away from a consumer hardware company to a software and services provider, similar to what IBM went through almost a decade ago. Both companies currently offer their own branded tablet devices, but have failed to secure a loyal customer base. Neither company currently offers smartphones.

“Major industry players are beginning to transition away from their traditional PC lines, and prefer to focus on their enterprise business units that promise higher profit margins,” says Ting Yang, Senior Research Manager for the Services and Telecommunication Research Group in IDC China. “Lenovo is without a doubt going to soon dominate the PC market.”

Lenovo, the worldʼs second-largest PC supplier in global shipments according to IDC, is so far the exception to the rule. Lenovo hasnʼt shifted its attention away from the PC market and shipments stayed level worldwide at 11.7 million. The company maintained profit growth by expanding its market share. Lenovo sales actually increased by 13% (1.1 million) in the US compared to the marketʼs double-digit contraction, and the Chinese PC manufacturer is close on the heels of HP to becoming the worldʼs number one PC supplier by volume.

In fact, Gartner, another information technology market research consultancy, places Lenovo ahead of HP as the owrld’s largest PC supplier, with a 15.7% market share to HP’s 15.5%.

Lenovo’s strategy is unique among the world’s leading PC manufacturers, and is not easily copied.

Protect…

Since it acquired International Business Machineʼs (IBM) PC unit in 2005, Lenovo has grown into a force to be reckoned with through overseas acquisitions, aggressive pricing and by protecting its dominance in the China market.

According to Lenovoʼs 2012 third quarter reports, PC sales grew 16 points faster than the market with a record market share of 15.9% (IDC figures) and record earnings of $205 million.

Lenovo credits its ʻprotect and attackʼ strategy for their healthy results: they protect their two profit pools, global commercial PCs and China, while attacking high growth opportunities like emerging markets and ʻPC Plusʼ products such as smartphones, tablets and smart TVs.

“ʻProtect and attackʼ is not just a geographical strategy, it also applies to our products and guides our investments. We protect our core business in PCs and attack new opportunities that exist in smartphones and tablets,” says Chris Millward, Global Communications Director for the Lenovo Business Group. “In the past year we have begun to focus on what IDC refers to as ʻsmart connected devices.ʼ This term refers to connected PCs, tablets and smartphones. Thatʼs what ʻPC plusʼ is really all about: smart connected devices.”

So far ʻprotect and attackʼ has proven a sound strategy. Lenovo-branded smartphone sales have doubled year-on-year, and its overall smartphone product line became profitable for the first time. The companyʼs worldwide tablet sales volume increased by 77%, and Lenovoʼs Mobile Internet and Digital Home Business Group (MIDH)—tasked with creating mobile Internet devices such as tablets, smartphones and smart TVs—now accounts for 11% of Lenovoʼs overall revenue.

The ʻprotectʼ part of the equation is particularly key as much of Lenovoʼs success can also be attributed to China, where its PC sales outnumber those of its next four competitors combined. 44% of Lenovoʼs sales came from China alone. None of the Chinese PC manufacturerʼs major competitors can fall back on markets where they enjoy this kind of home field advantage.

“We are really good at protecting our core businesses,” says Lenovoʼs Millward.

But having China in its pocket hasn’t stopped Lenovo from making efforts to innovate its PC product lines.

For instance, the companyʼs latest offering, the IdeaCentre Horizon, claims to be a family-centric multi-user touch interface tabletop PC. This deviates from the traditional definition of “personal” computing by creating a platform that groups of individuals can use simultaneously, rather than individually.

“In truth, the Horizon started out as a desktop PC, but we realized that personal interaction was limited to calling somebody over to briefly share in your workspace on this kind of platform. Real-time interactions happening in the real world remained rather small. The Horizon changes this by creating a device that groups of individuals can use together to create a stronger community environment,” says Millward.

Lenovo has even inked deals with gaming industry titans Electronic Arts (EA) and Ubisoft to customize games that combine physical gaming hardware with touch-screen game play—an activity that Lenovo refers to as “phygital”.

Lenovo is clearly exerting effort to keep its PC products fresh in an age where even the word ʻPCʼ evokes images of clunky boxes sitting atop drab work desks. Lenovoʼs laptop/tablet hybrid devices such as its IdeaPad Yoga and its smaller counterpart, the IdeaPad Yoga 13, feature a 360-degree hinge that allows them to be used as both personal computers and tablet, making the products the first in the market to offer four ʻmodesʼ, or positions, in a single device. In the IdeaPad Yoga, Lenovo caught on to a key consumer demand trend: versatility in as tight a package as possible.

“We donʼt want consumers being tied to having multiple platforms to meet their needs. Consumers are looking for a device that adapts to needs on the fly. Multi-mode devices such as our YogaPad are a perfect example of the kind of innovation that has kept us strong in the PC space,” says Millward, adding that Lenovo has maintained a 40% US market share in this category.

In contrast, HP CEO Meg Whitman openly admitted in a February 2012 investor conference call that her company “underinvested in innovation for the last several years and we’ve been late to market too often.”

HP, for instance, does not offer laptop convertibles similar to Lenovoʼs YogaPad, nor has it announced plans to create multi-user devices to compete against the Horizon. Rather than innovate, HP has followed a more traditional approach by upgrading traditional laptops and ultrabooks with longer battery life and faster processing speeds, which has failed to find traction with modern consumers.

Dell used to be an industry leader in innovation in the early 2000s by offering customizable PCs on its online stores, but during the past decade it has lagged behind its competitors in offering new products, such as tablet PCs, and shut down its smartphone business globally in 2012. Executives at Dell have said that the company will expand its software and service business for large companies, but have not given specifics on how it will revive its low-margin PC business.

…And Attack

Smartphone shipments totaled 671 million units in 2012, 45% more than shipped in 2011, according to Juniper Research, and sales are predicted to nearly double by 2016 as new phones continue to enter the market, according to NPD DisplaySearch.

Smartphone industry titans such as Samsung, Apple and Nokia credit a substantial portion of their revenue streams to the successful rollout of increasingly powerful handsets. With profit margins like Appleʼs 37.4% and net profit increases like Samsungʼs 42% climb from 2012, itʼs little surprise that Lenovo has re-directed its attention on the mobile market.

Lenovo has confirmed its commitment to become the number one supplier of handsets in China—and maybe the world—by unveiling six new models at the Consumer Electronics Show (CES) in Las Vegas earlier this year.

Lenovo is betting heavily on its ability to steal customers away from China market leader Samsung through enhancing brand awareness, the introduction of new devices like the companyʼs new IdeaPhone K900, and expanding its retail network.

Taking a page from Nokiaʼs playbook, Lenovo has also signaled that smaller and simpler smartphones at a lower cost to the consumer may appeal to users in developing markets and BRICS (Brazil, Russia, India, China, South Africa) nations. Lenovo offered its first touch-screen handset in China in 2010, and has rapidly expanded sales in India, Vietnam, Russia and the Philippines in the past year.

Lenovo finalized a deal in January to purchase 100% of Brazilian electronics manufacturer CCE, one of Brazilʼs leading manufacturers, allowing Lenovo to double its market share there. In India, Lenovo announced late last year its intent to solidify its presence in the Indian handset market by launching five new Android smartphones. Lenovo calls this its “global-local” strategy, another way of saying it will adapt to local market conditions, and quickly at that.

Speed to Market

Lenovoʼs ability to catch trends and develop corresponding products quickly has been a company trademark.

Another example of speedy delivery is Lenovoʼs LePhone A60, one of Lenovoʼs newest smartphones to hit the Chinese market. The LePhone took less than six months to develop, less than half the time it takes its competitors to research and develop a new product. By comparison, Apple unveils a new iPhone once a year. This shortened research and development cycle allows Lenovo to rollout new devices faster than its competition, which in turn allows it to corner market share as a first-mover.

“This is our secret formula to success,” says Millward, declining to go into details. IDCʼs Yang says itʼs a question of budget and personnel allocation, but it looks like for now the secret sauce is staying secret.

Less secret however is Lenovoʼs recent internal restructuring, which factors its strengths and weaknesses in order to stay nimble and responsive.

Divide and Conquer

Lenovo Chairman and CEO Yang Yuanqing has indicated his hopes that a recent organizational structure within the company that divides the company into two business groups (Lenovo Business Group and Think Business Group), may allow Lenovo to better target the high-end segment.

“We tried to push the Lenovo brand in mature markets but we realized that, as a brand, Lenovo only works in the mainstream and low-end market. In the high-end markets, Think is our best brand asset and the only brand which can compete against Apple,” Yang wrote in an internal company email in January that was leaked to Chinese online forums.

“It makes sense for Chinese companies to separate their premium brands from their more local brands,” says CKGSBʼs Teng. “This kind of division would give Chinese companies more flexibility, allowing them to target both global and regional markets.”

The Think Business Group will focus on Lenovoʼs Think-branded PCs, as well as enterprise business products. The Lenovo Business Group will focus on lower to mid-range PCs, tablets and smartphones. As with any changes made to a companyʼs internal organization structure, Lenovo runs the risk of overextending its iconic Think brand in its attempt to appeal to a larger consumer base.

“Lenovo must be strategic in how it positions its brand image. The company does not want its two product groups [Think and Lenovo] to steal the other’s market share,” says Tiger Shang, Group Account Director at brand consultancy Millward Brown.

China Equals Security

No other major PC manufacturer can rival Lenovoʼs presence in the China market, and as the countryʼs lower income citizens rise to middle income status, Lenovo can bet on millions of eager consumers to purchase their first personal computer in the years to come—likely a Lenovo product. So while we can laud the companyʼs shrewd business strategy, product innovation, and speedy R&D, it canʼt be ignored that security in the China market is undoubtedly what allows it to ʻattackʼ new markets with vigor. But Lenovo is producing lines of products that point to a larger industry truth about the state of the PC and whether itʼs in decline or in a transitional period.

Despite claims to the contrary, the personal computer is still relevant in that the definition of ʻPCʼ is getting hazier and hazier, allowing for all kinds of traditional technical demarcations to evaporate. Who says a tablet with a detachable keyboard isnʼt a PC? IDCʼs exclusion of such devices from their PC definition is arbitrary. It used to be that a PC was defined by an internal disc drive, but when was the last time anyone used a disc that wasnʼt a movie? Things are no longer so black and white.

Lenovoʼs lesson for those companies outside of China is whoever jumps head first into the new gray areas will reap the benefits. In a way, all smart device makers are playing catch up to Apple, but Apple is an extremely premium brand with premium price tags to match. If lower market PC manufactures can redefine themselves just as the PC has been redefined, offering products that breach traditional boundaries, then Lenovo may find itself in good company.