How companies like Tencent are finding ways to keep their services free

China is in love with Tencentʼs mobile chatting application, WeChat (Weixin in Chinese). The service—a close copy of the US application WhatsApp but with novel features like a ‘shakeʼ function to add new friends and walkie-talkie-like voice chatting—had more than 260 million users in China as of April 2013, according to company figures, after only a little more than two years of operation.

But like many who fall in love, We-Chatʼs users can be a fickle bunch. “My opinion is that if they start to charge, most people will stop using it,” Chaoping Zhu, a 36-year-old IT worker in Shanghai, says of the Tencent application. “Currently itʼs very cheap, very convenient, but itʼs also very easy to be duplicated by others.” If he had to pay, Chaoping says, he would switch from WeChat to a similar free program, such as Momo, a location-based social networking and dating application, or Tencentʼs old chatting standby, QQ.

Most young Chinese agree with him. An online poll by the official Xinhua News Agency found that around 90% of WeChat users said they would drop the service if it began to charge. The question became a hot topic in March, when technology minister Miao Wei said that Chinaʼs telecom operators might put pressure on Tencent to start charging for the application because of its heavy use of bandwidth. (See Would you pay for WeChat?)

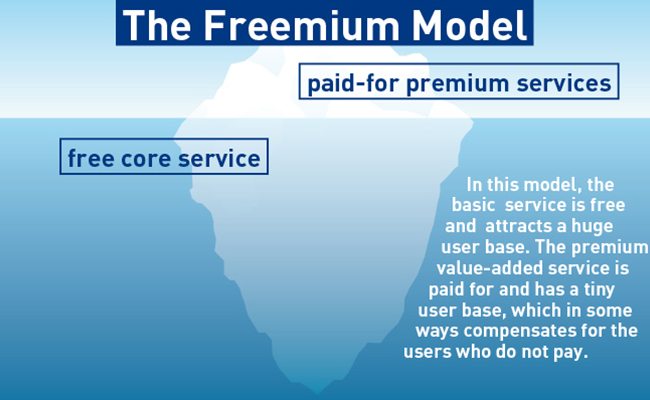

Tencent clarified at the beginning of April that it was unlikely to charge for using WeChat. However, analysts have said the company would likely generate fees from the product in other ways, for example introducing games with paid-for virtual bonus items, such as armor, weapons or medicine. Tencent officially announced their plans to add games to WeChat in mid-May. In doing so, Tencent will adopt what the technology industry terms a ‘freemiumʼ business model, in which a basic service is provided for free, with the goal of getting some users to upgrade and pay additional fees for premium features and functionality. “Itʼs very much a ʻbuild it and they will comeʼ mentality,” says Michael Clendenin, Managing Director of RedTech Advisors, a Shanghai-based research firm that specializes in the technology industry.

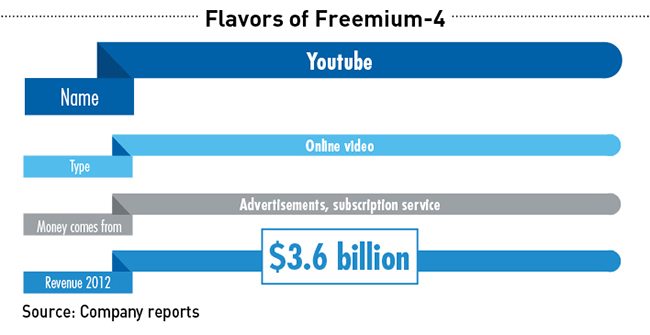

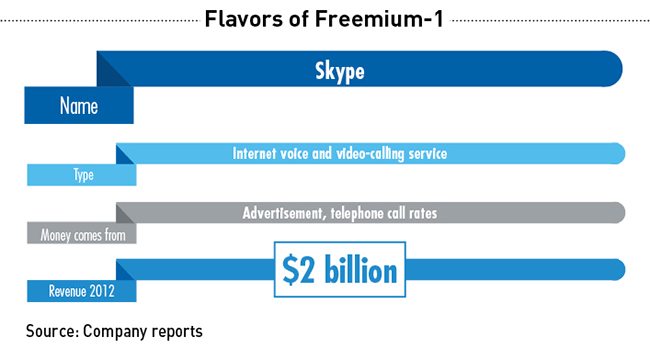

Freemium has become a widely adopted business model in the tech world, supporting such success stories as file-sharing service Dropbox, note-taking software Evernote and internet calling service Skype (See The Land of the Freemium). But for countless other companies, providing a unique and useful service for free while still covering costs has been a tricky prospect. Many freemium services and applications, including several Chinese Craigslist clones, have gone out of business, and high-profile tech executives like Alibaba Groupʼs Jack Ma have commented that free is no longer a sustainable business model.

Analysts say Tencent has the experience and cash reserves necessary to generate substantial returns from the freemium model. But for the scores of smaller Chinese tech companies that Tencent is driving out of business, the future of freemium looks far less certain.

The Rise of Freemium

The basic business model of freemium has been around since the 1980s when software companies began offering trials of their products for a limited time or with limited features in an effort to gain more users. In the last decade, the model has proliferated, appearing everywhere from free-to-play games to the ‘softʼ paywall of The New York Times, which allows readers to view a set number of articles for free each month before asking them to pay.

The decision to offer digital goods for free was not motivated by a newfound generosity towards consumers, but simple economics.

He Chuan, Associate Professor of Marketing at the Leeds School of Business at the University of Colorado at Boulder and Visiting Professor at Cheung Kong Graduate School of Business, says that the freemium business model stems from a much older concept—offering a low-priced basic service and a high-priced premium service. In the internet age, however, the marginal cost of producing a digital good has dropped to almost zero, making the freemium model possible, says He.

In the old days, a music company would incur a significant cost for producing and selling a CD. Today, duplicating and distributing an MP3 file on the web costs almost nothing, so competition pushes companies to offer free products.

The business model can also be seen as a kind of “unbundling”, or selling certain digital services separate from others in order to serve customers of all demand levels, He says. This allows a company to tap value from all its users and maximize revenue, while also removing an initial barrier between many potential customers and product trials.

Mark Natkin, Managing Director of Marbridge Consulting in Beijing, says online game companies in particular have benefited from unbundling their services. Most companies used to offer their games on a subscription basis, where a consumer would pay for their game time upfront. But that derailed many potential users.

When companies began letting people play for free and purchase items in the game as they liked, they not only attracted larger user bases, but also earned more. “The idea is you donʼt leave anything on the table. You basically get all the revenue you can from every user,” says Natkin.

The proclivity for maximizing revenue has pushed freemium to become the dominant model for mobile applications in recent years. Analytics firm IHS iSuppli estimates that in-app purchases will account for 64% of global application revenue by 2015, up from 39% in 2012 and less than 20% in 2010.

The model is also particularly suited to China. First, consumers have less disposable income on average, and therefore are more likely to be discouraged by an upfront payment for a digital product.

“I think China is a much tougher market, because average incomes are much lower than the West,” says David Zhu, the CTO and Co-Founder of Hong Kong-based Enterproid, which is developing a free-to-use mobile application called Divide. Divide creates a separate and secure workspace on a workerʼs personal phone, protecting the workerʼs privacy and eliminating the need to carry around a separate BlackBerry for work. “Chinese businesses have to be a lot more creative in getting users to ʻimpulse buyʼ or really pay for services. They need to take revenue where they can get it.”

Second, the freemium model can help to protect online services and applications from Chinaʼs rampant piracy. Most game companies in the West generate revenue by selling discs or CDs with their games; in China, however, these can be duplicated by pirates within weeks. With the free-to play model, gamers log on to the operatorsʼ servers to play the game, and operators generate most of their revenue from in-game advertising and micropayments, rather than a one-time fee.

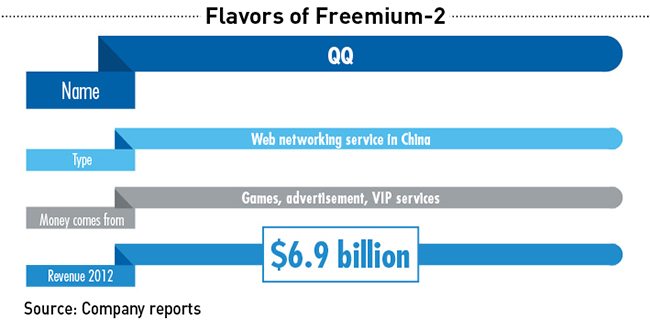

Tencent in particular has built one of the worldʼs biggest gaming empires off of the free-to-play business model. The company generated RMB 43.89 billion ($7.1 billion) in revenue in 2012, up a stunning 54% year-on-year. Its profits for the year were RMB 12.78 billion ($2 billion), up 25% annually.

“Tencent is famous for developing this model in which, instead of charging a sizable monthly user fee, you let everyone use your products for free and introduce a variety of value-added services or virtual items. If you have an enormous user base, this adds up to fairly significant revenues,” says Natkin.

No Such Thing as Free

The freemium model has generated big profits for some companies, but it also presents significant challenges.

Companies that adopt a freemium model must recruit large user bases to succeed, since typically only 2-5% of users choose to pay for premium services. But whether a company can amass the necessary users is a big gamble, especially for a start-up. With so many applications available free online, thereʼs no guarantee that even a great product will reach consumers.

After receiving digital services and products for free for so long, consumers have also become tight-fisted. The tech industry describes this phenomenon as “the penny gap”, meaning that the demand for a free service can be many, many times more than the demand for one at the price of one cent. In China, video site Youku faces such a gap: the siteʼs high-definition video service, which charges roughly $1 a month, has been relatively unsuccessful. The service has been running for several years, but it still generates less than 1% of revenue, says Clendenin.

Succeeding with a freemium model also requires striking a careful balance between providing an experience that is compelling enough to get someone hooked, but yet preserving enough value so premium users feel theyʼre getting their moneyʼs worth, says Zhu of Enterproid.

Many companies—including Chinaʼs rash of Groupon and Craigslist clones—have flopped after failing to discover that secret recipe. “If their costs are high to begin with, then all of a sudden their runway for innovation becomes very short. They can run out of money before they stumble across a viable business model,” said Clendenin.

Succeeding with a freemium model is particularly challenging now that huge companies like Tencent, Alibaba and Baidu have come to dominate Chinaʼs digital landscape. These companies have diversified business models and generous cash reserves, and can afford to run some services at a loss to augment their user traffic.

They have also taken advantage of Chinaʼs lax intellectual property environment, employing teams to reverse engineer popular technologies from around the globe, as Tencent did with WhatsApp after it was released in 2009. China offers “a distinct advantage for large established companies that donʼt mind copying others. So that clearly is right up the alley of Tencent, which is a large company known for copying others,” says Clendenin.

Big players can copy faster, gain users faster and afford to offer free services for much longer than any small company, Jack Ma, the Founder of Alibaba, said in a speech on April 1. Although the free tech service model worked when Ma founded his e-commerce empire 10 years ago, it no longer works today, the Chinese entrepreneur told a conference in Shenzhen. “Ten years ago, Tencent, Baidu and Alibaba were very young. Today if you go free, Tencent, Baidu and Alibaba would help you die. You cannot survive with ideas that worked five or 10 years ago, or in last century,” Ma said.

An Uncertain Future

Tencentʼs innovative use of the freemium model helped it become one of the worldʼs richest technology companies, and analysts say the company should have no problem in making WeChat another commercial hit. “WeChat is going to enable them to print more money than the central bank,” says Clendenin of RedTech Advisors.

Tencent executives said in March that they would be testing a gaming platform for the service in the next few months. The company seems likely to use the same virtual micro-transaction model used in their desktop-based gaming systems, as well as sell items like special emoticons or videos that can be sent to other users.

But the freemium model will be far more difficult for Chinaʼs smaller tech companies to pull off. To survive, small Chinese companies need to return to roots of marketing, analyzing consumer needs and pinpointing still-profitable sectors. “The trick is understanding the nature of [the freemium] model, unpacking the product to cater to different customer valuation,” says CKGSBʼs He.

That will be difficult, but if applied intelligently, the freemium model has a bright future. “This is an old trick, new packaging,” says He. “It will be there forever.”