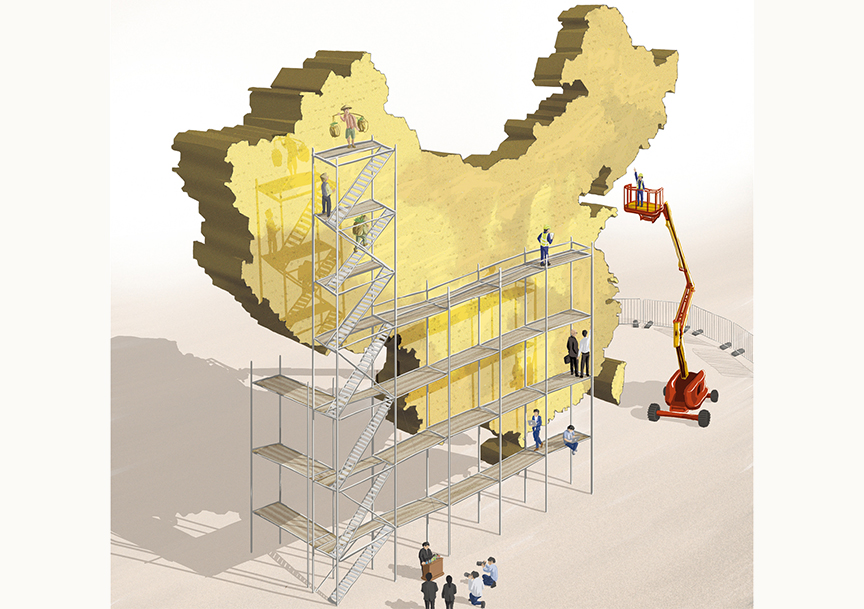

China is not suffering for lack of international attention. Between its booming economy, its controversial monetary policy, and its newfound role as the world’s banker, there’s been no dearth of China news in the West. Yet international investors still know relatively little about the country they deem so important. And, sometimes, with ignorance comes fear.

The result is “familiarity bias”, a concept Cheung Kong Graduate School of Business Professor of Finance H. Henry Cao uses to explain why many investors favor companies that share their culture or language–and avoid those that don’t. People tend to treat choices that deviate from the status quo as riskier, Cao argues, regardless of reality.

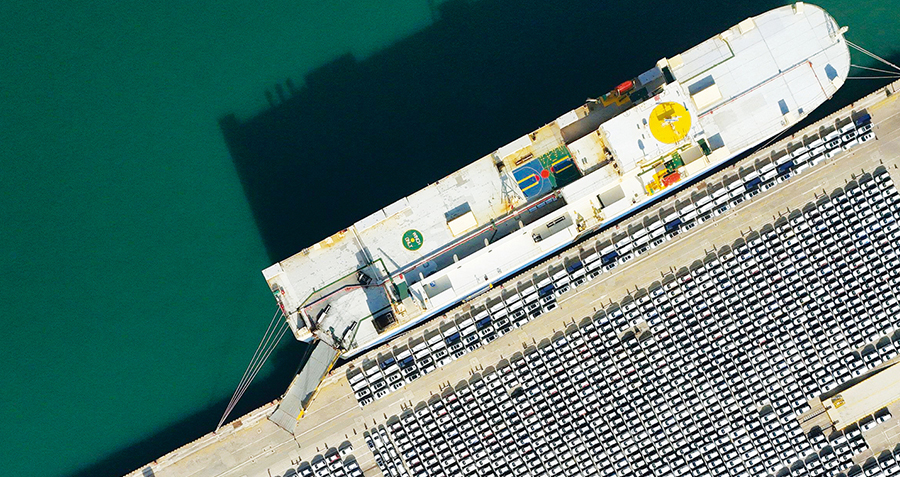

To Western investors, Chinese businesses may seem especially unfamiliar, and none more so than Chinese state-owned enterprises (SOEs). Although the number of private firms is growing in China, most large, successful companies are still state-owned. Investments by SOEs accounted for 89% of large investments ($100 million or more) made by Chinese companies in the year ending in July 2011, according to the Heritage Foundation. Yet Chinese SOEs are often perceived to have different objectives from private corporations. While private companies are profit-driven and responsible to shareholders, some investors believe, the motives of SOEs are more political and strategic than commercial.

As a result, many of these giants have been rebuffed when they’ve tried to expand overseas. Between 2005 and mid-2011, seventy PRC business deals, each worth $100 million or more, completely or partially failed, with a total value of $165 billion in lost revenue, according to Heritage Foundation data. Two prominent examples are the rejection of a bid for U.S. oil company UNOCAL by China National Offshore Oil Corporation (CNOOC) in 2005, and the rejection of the Aluminium Corporation of China’s (Chinalco) 2009 bid for an 18% stake in Anglo-Australian mining company Rio Tinto. Both deals were criticized in the United States and Australia for potentially harming national security–or, even vaguer, the “national interest.” The SOEs could serve as arms of the Chinese government, critics warned, and may have more than just commercial motives.

Chinese leaders attributed the failures to discrimination. Luo Tao, chairman of China Nonferrous Metal Mining, this year deplored the “bias” shown against Chinese investors. In February, Beijing formally complained that Washington was blocking Chinese investment in U.S. companies.

The evidence suggests suspicions of Chinese SOEs’ motives aren’t especially warranted. A recent International Monetary Fund working paper shows that 52% of Chinese corporations, the vast majority of which are SOEs–issued dividends in 2007–higher than the world average of 49%. This rate “suggests strong respect for shareholders’ rights,” according to the JP-Morgan’s September Investments Insights report. “Investors should see this data as proof of solid corporate governance and smart management throughout most of the Chinese corporate universe.”

Zhang Yongsheng, a senior research fellow at the Development Research Center of the State Council, dismisses nationalistic concerns. “The motivation of China’s SOEs is mainly profit-driven rather than to control markets or the economy,” he says.

Familiarity bias could help explain the breakdowns. After Rio Tinto withdrew from the Chinalco takeover bid in 2009, it set up an iron ore joint venture with Australian rival BHP Billiton. Peter Drysdale, emeritus professor of economics at The Australian National University, who has published extensively on foreign investment in Australia, said there were “complementarities (or ‘synergies’) between BHP Billiton and Rio Tinto, at least at the operational level.” Rio’s shareholders were perhaps more comfortable working with a Western company whose business culture was similar to Rio’s.

Part of the burden for reducing familiarity bias falls on Western governments and business. Step one: Learn Mandarin. Foreign executives have a better shot at sealing a deal if they can speak frankly and directly with their Chinese counterparts, rather than through an interpreter. For executives, visiting potential business partners in China is also essential. This will provide a clearer perspective of how things work on the ground, compared with simply reading reports and figures in the office back home.

SOEs also bear some responsibility for the unfamiliarity. They could make corporate governance more transparent– and therefore familiar–to potential business partners. Jonathan Woetzel, a director in McKinsey & Company’s Shanghai office, suggests that investors judge a company not by its ownership, but by its level of openness. After all, the fraud allegations against Chinese companies listed in the United States in 2011 were directed mostly against private enterprises.

One indicator of openness is hiring foreign talent. Minmetals Resources, a Chinese mining SOE operating in Australia, decided to outsource management to local experts in 2009. The company is now one of the most successful SOEs outside China and has become a model for other Chinese companies looking to do business overseas.

By not examining Chinese SOE investment objectively on a case-by-case basis, Western countries risk losing good opportunities to help their economies. In that sense, foreigners overcoming their fear of China–and vice versa–isn’t only a matter of sentimental cultural exchange, but also pragmatic self-interest.