Chipping away

Economic Refurbishment

Meeting in the middle

What’s on the menu?

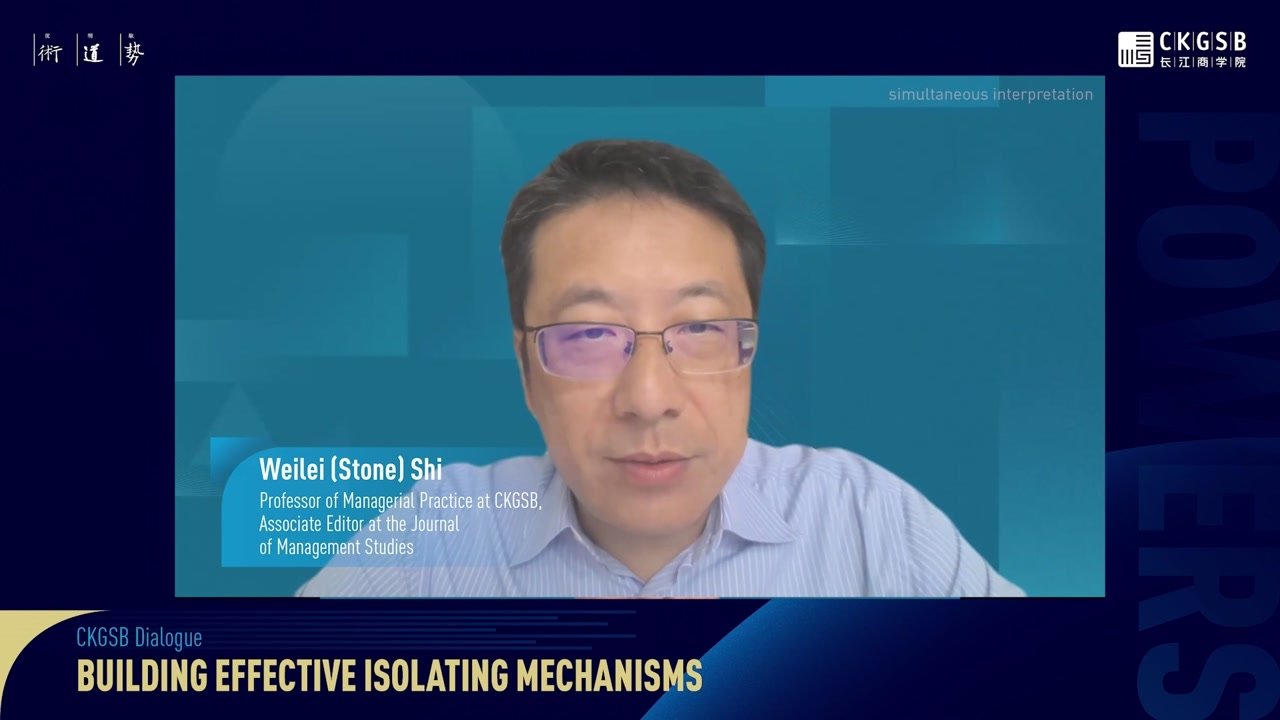

PROFESSOR ANALYSIS

See More

CKGSB Publication

Unleashing Innovation: Ten Cases from China on Digital Strategy and Market Expansion

Unleashing Innovation: Ten Cases from China on Digital Strategy and Market Expansion tells the stories behind eleven remarkable companies in China, including Chinese companies and global MNCs, leading the way in tech innovation and international expansion.

Discover