Playtime in China is more about learning than fun and games

Ke Chenyi laughs when she compares her childhood toy box with that of her six-month-old daughter. “As a baby, I had no toys,” she remembers. “Later I had a box of fake Barbies and a stuffed monkey. Apart from those, we kids used to make up games by ourselves using simple, everyday things.”

Ke lives in Shanghai with her daughter, Ina, who has more toys in her room than her mother ever had throughout her entire childhood. During the 1990s, when China’s per capita gross domestic product (GDP) level was less than one-sixth of today, buying toys was not high on most Chinese parents’ priorities. But as income levels have soared, so has the amount of money that they are willing to spend to put a smile on their children’s faces.

Retail sales of toys and games in China leaped over 250% between 2011 and 2016, from RMB 89.7 billion ($13.8 billion) to RMB 232.17 ($35.73) billion, according to Euromonitor, a market research firm. Yet playtime remains very different for children in China compared to children in Europe or North America.

Play With a Purpose

Like many of China’s new generation of modern, highly-educated parents, Ke places a high value on her daughter’s playtime. But she expects a return on her investment.

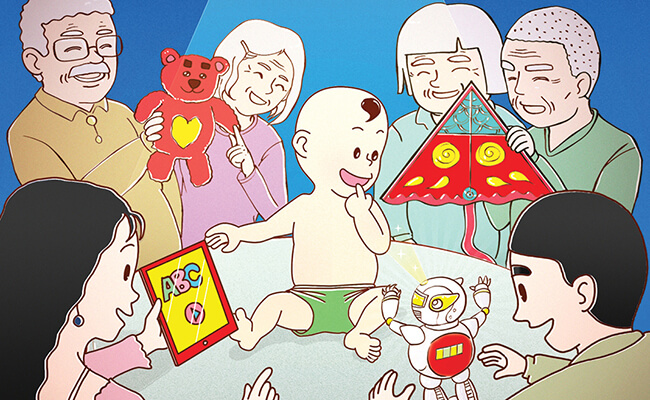

“These days we have a lot of play choices for our children, but almost all have some educational function,” Ke says. “In China, we always say that you need to win from the beginning. We Asians are very competitive and in this intense society, parents want their kids to be the best from the start.”

For parents in China, play should be constructive. Patty Wu, Mattel’s Vice President of China Growth, wrote in a recent blog post that mainland parents buy fewer toys for their children than parents in some other countries. She explained it is because they fear idle play distracts their offspring from homework, which will hurt their academic performance. Many parents see the purpose of toys as being to help children learn mathematics, English and writing Chinese, core skills essential throughout their education.

“There is pressure for children to start acquiring these important skills very young,” says Elisabeth de Gramont, Managing Director of customer engagement consultancy C Space Jigsaw in Shanghai. “Whether that’s math, learning characters or learning English—this starts well before primary school.”

Educational toys that help children to learn to count or to repeat English words, for example, have become popular with urban parents. But increasingly the requirements of parents born in the 1980s or 1990s is shifting demand for educational toys beyond the core skills demanded by the traditional Chinese education system.

“More and more parents have broader ideas about how they want to cultivate their child’s creativity, sociability and other abilities not learned in school,” adds de Gramont. “They understand play is an important way to do that.”

Both traditional and new digital toys reflect this emphasis on learning. An example is the pre-school toy Code-A-Pillar from Fisher-Price, a developmental toy that launched in China in 2016, which allows children to do basic computer programming and problem-solving. At the same time, building blocks and other traditional toys have enjoyed a return to popularity.

“Chinese parents prefer toys with intelligent exploitation functions,” says Carol Lv, analyst at Euromonitor. “Toys with educational functions are popular—construction toys remain the standout category in the market, and enjoyed the most dynamic value growth amongst traditional toys and games.”

Lv explains that parents are willing to buy construction toys for children to develop creativity and concentration. What is particularly important for Chinese parents, aside from the safety of the toy, is not whether it is digital or analog, but its content.

“When talking about toys and play, the primary motivation for parents, I think, is still about having toys that have learning value,” reflects de Gramont. “You could call it purposeful play or directive play. They don’t want their children to be wasting time playing, they want play to have purpose.”

Where this is changing, she explains, is that learning used to be all focused on English or numbers. Now this has expanded to exercises that will help develop children’s logical thinking, or something that helps them learn to interact and socialize with others.

Playtime is Money

For toy brands, the biggest challenge in China is no longer families’ lack of disposable income, but rather children’s lack of time. With parents feeling under pressure to make sure their children can compete in the education system, finding time for play at all is becoming a challenge.

The schedules of Chinese children are grueling. A recent study by the Australian Financial Review found that the average child in China spent 77 hours a week studying.

In Shanghai, more than 70% of children aged between four and six years old attend extra-curricular classes, according to the Shanghai Association for Quality. The average family spend on such classes is RMB 17,832 ($2,744) annually, around a third of a typical Shanghai household’s annual disposable income.

With so many young Chinese in classes all day, toy brands are attempting to combine their products with a learning center or school. These branded ventures meet the demand of purposeful play in a structured environment and can help boost revenues as toymakers struggle to compete for a child’s time.

Disney has been one of the earliest movers in this area. Its network of English-language schools, which it established in 2008 and now found throughout China joins together play and learning with retail and brand awareness. This year, it also announced plans to expand its presence into China’s third- and fourth-tier cities.

Mattel, the owner of Fisher-Price, is also moving aggressively into the space. The company has formed three partnerships in China to push its brand. This year it announced plans with the Chinese platform Babytree to develop a network of learning centers across China to teach lessons such as Mattel’s Hot Wheels Speedometry. These play-based lessons teach children about subjects such as measurement, distance and kinetic energy through building miniature race tracks. Mattel expects this new venture to help quadruple its market share in China by 2020.

However, the champion of this approach has been Danish brand Lego, which was the most popular foreign brand in China by market share in 2016. Lego has made great efforts to position itself as a leader in educational play, investing heavily in research focusing on the cognitive benefits of play. It has also partnered with a leading Chinese university “to support creativity and play in Chinese schools” and launched a series of innovative education programs in Chinese kindergartens and schools.

These efforts complement Lego’s investment in other projects such as its giant Legoland Discovery center in Shanghai and its expanding range of apps and mobile games. Together, these helped the company achieve double-digit sales growth in China in 2016.

“If there’s one brand all mothers want, it must be Lego,” laughs Ke Chenyi. “It’s genderless, it’s very creative, it has high aesthetic and it’s good quality. I care very much about the creativity of the toys and want something active rather than passive, that Ina can use to create and discover for herself.”

Cluttered Toy Boxes

Foreign brands are far from dominant in China. Overall, China’s toy market remains extremely fragmented and foreign brands face tough competition from domestic brands. According to Euromonitor’s Carol Lv, although consumers generally consider foreign toys to be higher-quality, domestic companies still lead the market “with price advantages and wider sales distribution across the country.”

“If there’s a comparable domestic toy, it could be half the price and still decent quality,” agrees de Gramont. “There are a lot of fakes and counterfeits in big cities, particularly for iconic characters that are easily replicable like Barbie and My Little Pony. Parents and girls don’t know the difference or really care if they are fake, as long as they are cheaper.”

Domestic brands are starting to gain ground in the innovation stakes too. Toymakers are transforming their business models and paying more attention to R&D to compete with their international rivals, rather than just copying them.

Of Euromonitor’s top five brands by China market share, three were domestic brands. Yet, no player—foreign or domestic—had more than a 6% value share in 2016, reflecting the difficulty of designing toys to appeal across China’s broad wealth and social differences. The most popular toy manufacturer last year was innovative domestic company Alpha Group, which makes action figures, animations, remote -controlled toys and baby products, taking 5.3% of the market.

The toy market will continue to grow rapidly in China and the sheer size of the market makes the opportunity unique. Together with growing disposable incomes, there are 222 million children in China under the age of 14. The new two-child policy is expected to result in an additional 2.4 million babies born in China each year, contributing an extra RMB 75 billion ($11.5 billion) to the toy industry.

More growth is also expected in toys and play centers that help to build primary motor skills, creative and social skills, and core educational skills. There is certainly no sign of a fall in demand from mothers like Ke. “I think it’s important to activate their curiosity to try different things—building, music, art—that can stimulate the interest of the child and motivate them to study by themselves,” she says.