Alibaba is eyeing expansion into new sectors and overseas, but will old tactics serve on new terrain?

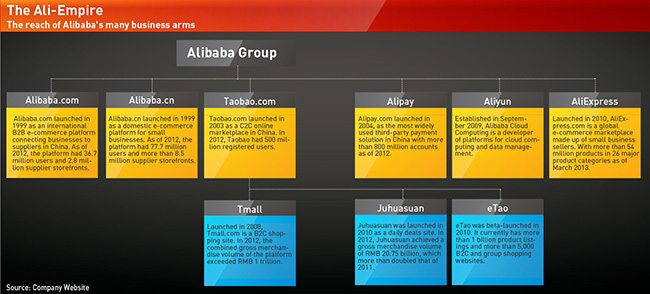

If Jack Ma has his way, the sun will never set on Alibaba’s empire. The billionaire entrepreneur’s internet giant rules China’s e-commerce roost, with 500 million registered users and RMB 1 trillion in total 2012 sales from Tmall, its business-to-consumer (B2C) site, and Taobao, its consumer-to-consumer (C2C) online store. Built into those sites is Alibaba’s secure online payment system Alipay, which holds nearly half of China’s RMB 13 trillion third-party payment processing market.

To stay at the top, Alibaba is expanding into sectors outside of its traditional wheelhouse. With Beijing’s blessing, it added RMB 5 billion to the coffers of its nascent micro-lending business in July. After stepping down as chairman, Jack Ma is now spearheading the development of a RMB 100 billion national logistics network to bring the small and medium-sized companies that are Alibaba’s bread and butter deeper into the e-retailing giant’s folds.

Despite its lofty ambitions, Alibaba’s fortunes are far from certain. Bold expansion into unfamiliar terrain can flop, as the company experienced during its abortive foray into internet search with Yahoo!. At the same time, the finance sector, paramount to Jack Ma’s growth strategy, remains one of China’s most controlled. The e-commerce playing field is also shifting to mobile where rival Tencent dominates with its powerful WeChat platform.

Newly acquired stakes in Sino-Weibo’s micro-blogging service and the mapping firm AutoNavi may help Alibaba shore up its weaknesses in mobile ahead of an expected listing on the Hong Kong Stock Exchange and potentially New York as well. The Hong Kong IPO value has been estimated at different amounts between $60 and $130 billion, according to a Morgan Stanley note released in February of this year. Alibaba’s new Chief Executive Jonathan Lu said last July that the company was ready to float, but did not specify when or where it would list its shares.

Should the mammoth IPO, touted to be bigger than Facebook, come to pass, founder Jack Ma would come one step closer to realizing his lofty ambition for international fame. Ma told shareholders in an annual general meeting in 2009 that their needs were secondary to his preeminent goal. “If Alibaba cannot become a Microsoft or a Walmart, I will regret it for the rest of my life,” he said.

The Rise

Working out of his Hangzhou apartment, former English teacher Jack Ma launched Alibaba.com in 1999 as a business-to-business (B2B) website that connected foreign buyers with Chinese suppliers. Alibaba raised $25 million from major institutional investors the following year, including Softbank, Goldman Sachs and Fidelity.

“Ma won that vote of confidence because he established himself early on as a leader in the construction of China’s internet,” says Edward Tse, Chairman Emeritus of Booz & Co. in Greater China.

Ma also secured his funding before the dotcom crash of 2000, which sullied the reputations of internet start-ups, says Porter Erisman, who worked alongside him as Alibaba’s Vice-President of global communications from 2000-2008. “It’s hard to imagine such a large investment would have come in immediately after the internet bubble burst,” he says.

Alibaba also expanded gradually, a tack which bested the breakneck growth of certain early competitors. The e-commerce firm 8848, named for the height of Mt. Everest’s apex, became an initial market leader at the dawn of the Chinese internet era. Also founded in 1999 as one of China’s first widely used e-commerce platforms, Time and Forbes both named it as one of China’s top websites in 2000.

After the 2000 dotcom crash, 8848’s funding dried up and its misallocation of resources among immature B2B and B2C businesses hastened the platform’s demise in 2001, says Tse of Booz & Co.

Alibaba also side-stepped the crash by calling for reinforcements in 2001 when the company hired former GE human resources executive Savio Kwan. As Chief Operating Officer, Kwan established a more effective HR structure when Alibaba was growing too quickly and lacked an organizational chart, says Erisman. “The HR systems helped Alibaba to succeed where other companies failed.” With HR systems fortified, the e-commerce retailer launched its third-party payment service Alipay in 2004. By holding payment for a transaction on its sites in escrow until the buyer received the purchase, Alipay became a secure online payment system at a time when few Chinese consumers used credit cards, and now processes 8.5 million transactions daily.

In the mid-2000s, Taobao had one major rival to challenge, but its attractive price point ultimately won it the market against eBay, the leading US-based C2C e-commerce platform. eBay eventually withdrew from China in 2005 because their business model of charging sellers to list their products proved too costly to Chinese users, says Erisman.

“Taobao allowed people to start a new business from their home with an internet connection for virtually nothing,” he says, adding that Taobao’s TV marketing campaign, an avenue ignored by eBay, also bolstered its brand and established trust with the consumers.

Van Gao, who with his wife Angeline Li operates a women’s clothing e-store they call Feerique on Taobao, earned RMB 9.2 million in revenue last year. “The payment system makes buyers feel secure that they won’t be cheated,” he says.

With eBay taken care of, Alibaba focused on its next platform: Tmall. Julia Zhu, a former Alibaba product manager and owner of Observer Solutions, a Washington D.C.-based consultancy that advises US investors in China’s e-commerce sector, says that Alibaba’s well-designed and easy-to-scale platforms have been vital to its growth, and Tmall is no exception. Founded in 2008, the B2C website has grown at an exponential rate and is on track to overtake Amazon by revenue in 2015 to become the world’s largest internet retailer, according to Euromonitor. Such scale has opened doors to other business avenues.

Easier Money

Alibaba established a micro loans business three years ago that has since extended over RMB 100 billion in credit to more than 320,000 small e-commerce firms and entrepreneurs. In July, the Chinese Securities Regulatory Commission authorized Alibaba to expand funding for its lending business by RMB 5 billion, highlighting how powerful the company could be in answering the fierce demand for financing from small enterprises.

Alibaba’s prospects in the lending business are promising, says Duncan Clark, Chairman of the Beijing-based technology consultancy BDA. “With the push from the central government to reform the financial sector and promote SMEs and the private sector, I think there are some favorable tailwinds for Alibaba in this area at the moment,” he says.

Teng Bingsheng, Associate Professor of Strategic Management at Cheung Kong Graduate School of Business, agrees Alibaba has Beijing’s backing for now. “The government wants to do some experimentation,” he says, adding that the new financing channel may put pressure on banks to up their small and medium sized enterprise lending.

But Tse of Booz & Co. points out that Alibaba’s forays into financial services face some entrenched opposition. “A nonbank getting into a banking activity is by definition a gray area. Alibaba could be seen as encroaching on their territory.”

For now, Alibaba’s micro-financing business is a non-threatening 0.1% of the total credit provided by China’s banks.

Martin Liu, Associate Professor of Marketing at Nottingham University’s Ningbo campus, is also skeptical of ‘the Bank of Alibaba’. “The government may be supporting Alibaba’s lending business now, but in China, a lot of things are not set in stone,” he says. “I don’t think it [the lending business] will fulfill its promise.”

Alibaba’s lending business has been made possible by utilizing its massive data stores, which are unique in their size and scope in China.

The Big Data Advantage

Alibaba’s expansion into Big Data will place the company on more familiar ground as it aims to use its vast data collection accumulated over 14 years to make its different platforms more competitive.

Big Data refers to the relatively new technology that allows for the processing of vast amounts and categories of data at higher speeds than ever before. Western companies have been leveraging Big Data increasingly over the past several years, and in China, no one’s in a better position to capitalize on the technology than Alibaba.

Big Data will allow Alibaba to understand consumers’ behavior in the past and to some degree predict how they will act in the future, says Clark of BDA, making it a great asset in developing product roadmaps as well as understanding credit risks in its lending business. “It’s a very serious advantage,” he says. Big Data will also be instrumental in the development of its national logistics network in which Alibaba and its partners will invest up to RMB 100 billion over the next five to eight years. Jack Ma will serve as CEO of the Alibaba-led consortium, which is called Cainiao Network Technology. Cainiao aims for its smart logistics system, which will include its own national network of warehouses, to deliver online orders to customers in 2,000 Chinese cities within 24 hours.

Cainiao will use Alibaba’s location data to select prime locations for warehouses and optimal delivery routes, says Zhu. The completed network will provide a logistical infrastructure that Chinese SMEs badly need, ultimately lowering their costs of doing business, she says.

The logistics network will also strengthen Alibaba’s hand against rival Jingdong Mall (JD.com, which previously used the URL 360Buy.com), which is the second-largest e-commerce firm in China and has a dedicated logistics network of its own. “The prevailing view is that the quality of the products on Alibaba’s sites is not as reliable and the delivery not as consistent as on 360Buy,” says Tse of Booz & Co.

But Zhu of Observer Solutions believes Jingdong is outmatched against the new Cainiao consortium. “Since they operate the logistics network alone, there is a limit to how much they can scale it up before they run out of cash,” she says.

Alibaba owes its ample cash reserves to many things, not the least of which is its American investor Yahoo!.

Missed Opportunity?

Jack Ma seemingly made a major strategic miscalculation in Alibaba’s business relationship with Yahoo!, likely squandering the chance to make Yahoo! China one of the nation’s leading search engines.

According to Erisman, the primary reason Alibaba chose to partner with Yahoo! in 2005, in which Alibaba exchanged a $1 billion investment in Yahoo! China for Yahoo!’s 40% stake in Alibaba Group, was to add search engine advertising for SMEs to its e-commerce portfolio. For its part, Yahoo! hoped Alibaba could breathe new life into its ailing China business. Yet according to Erisman, Ma mistakenly allocated resources to marketing that should have been first used to develop the technology of the Yahoo! search engine, which led to an inferior product that prompted users to migrate to Baidu and Google.

Political friction stemming from China’s requirement that Yahoo! censor its search results also contributed greatly to the unraveling of the Alibaba-Yahoo! tie-up. “Their partnership was really doomed once Alibaba became more important to the Chinese economy and Yahoo!’s role as an investor became a liability and threat to Alibaba’s operations in China,” Erisman says.

The doom manifested this month when Yahoo! folded its China email service, the latest of Yahoo!’s planned China operation closures.

But it wasn’t all for nothing, says Tse of Booz & Co. “The cash Alibaba got from Yahoo! was quite critical in supporting Alibaba’s subsequent businesses such as Taobao. Yahoo!’s stake in Alibaba continues to appreciate given Alibaba’s good performance,” he says.

An Empire at War

Paramount to Alibaba’s long-term prospects is its ability to recalibrate its business for the mobile era. Rival internet giant Tencent has a formidable mobile ecosystem that includes the tremendously popular WeChat voice and text messaging application.

Tencent aims to use WeChat to expand its operations in e-commerce and has developed a mobile payment center on the app as a rival to Alipay. In early August, Alibaba cut off access to WeChat blocking quick response (QR) codes, which can lead an online shopper to complete a transaction via WeChat’s payment system when scanned by a smartphone, and penalizing violators by lowering their ratings on its sites.

“Alibaba is feeling extremely threatened by WeChat,” says Kevin Der Arslanian, an analyst and tech-industry specialist at the Shanghai-based China Market Research consultancy. In his view, a weak social-media footprint in mobile presents the greatest danger for the e-commerce giant’s future prospects. “As they are getting close to the IPO, it could affect the price of the stock,” he says.

To strengthen its mobile internet portfolio, Alibaba recently invested $586 million for an 18% stake in Sina-Weibo. “They needed something quickly and Weibo is the only platform that can compete with WeChat,” says Zhu of Observer Solutions.

“Mobile is one of the key wins Alibaba needs to get,” says Der Arslanian.

At the same time, Alibaba must not neglect its government-relations strategy as it becomes involved in the sensitive social media sphere, says a businessperson familiar with China’s relevant government policy, who prefers to remain anonymous. “Any firms that work in fields that deal in information that could be critical of the regime—the press, book publishers or social media—need to be tightly controlled by Beijing”, he says, adding that Alibaba’s investment in Weibo will require the company to “increasingly collaborate with the government”.

James McGregor, Chairman of APCO Worldwide’s Greater China region, says a firm like Alibaba can reap all the success it wants as long as it behaves. “So they [government officials] basically came to them and said, ‘you can make money as long as you behave and if you don’t behave, you’re toast.’ So they all learned how to behave, meaning you don’t put out information that challenges the government and if people who are your users do, you delete it.”

Luckily, Alibaba’s status as a powerful private company has turned out to be a political asset, says the businessman. “If anything, it’s a good example for Beijing of successful private enterprise, and if it becomes strong abroad it’s a nice vector for China’s soft power.”

A Global Powerhouse?

Aside from recent extensions into Hong Kong, Macau, and Taiwan, analysts expect Taobao and Tmall will next expand to Southeast Asian markets with high ethnic Chinese populations, such as Singapore and Malaysia.

Further international expansion has yet to be mapped out, although a massive IPO would provide Alibaba with ample liquidity to develop a more global network and make overseas acquisitions in developed markets, Tse of Booz & Co. says. Alibaba launched English-language AliExpress internationally in 2010 and eyed the US market in particular. That same year the company announced a $100 million (RMB 6.2 billion) investment plan, which included the acquisition of California-based tech company Vendio Services Inc.

Unfortunate for further US expansion was Taobao’s presence on the US Trade Representative’s Notorious Markets list through the end of 2012, which highlighted it as a platform where dealing in counterfeit goods was prevalent. Taobao has tried to clean up its image in the US since, but is likely now in temporary retreat mode from the world’s largest economy.

The Middle East, Africa and Southeast Asia offer greater opportunity for the expansion of Alibaba’s B2B businesses, Der Arslanian says. Compared to the US, where eBay and Amazon dominate, “there is still plenty of low-hanging fruit in emerging markets”, he says, adding that “it would be hard to adapt for Western markets where a trend of niche-market platforms is emerging,” citing UK-based SoJeans, the first European-based e-store to specialize in denim, as one of the more successful examples of that trend.

While Alibaba must overcome major hurdles to expand globally, its potential should not be dismissed just yet. Jack Ma has faced down plenty of skeptics from the beginning and prevailed. In 1995, he first approached government officials in Beijing for support in building an internet for China and was rebuffed. The government bureaucrats had no interest in partnering with an unknown entrepreneur. “At the time, nobody believed people in China would buy anything online,” says Zhu of Observer Solutions.