Increasingly sophisticated online consumers are pushing China’s cyber retailers to the next level

Just as clever marketers have whittled the meaning of Christmas down to the goods that are gifted on the 25th of December, festive days in China are quickly following suit. Singles Day—a celebration of bachelorhood on the 11th of November—seems to have been hijacked by online retailers and molded into a shopping extravaganza. A short eight hours after price cuts began at midnight on the 11th of November, 2012, one of China’s leading online shopping platforms, Tmall, made record sales, hitting $800 million.

But retail highs quickly fell to frustrating lows. Online shoppers complained of slow delivery, fraudulent promotions and false advertising. More than half of the 8,160 complaints about online vendors submitted to the China Electronic Commerce Association in November related to Single’s Day.

Aware of an increasingly vociferous consitutency, vendors have made attempts to serve their needs. Taobao, for example, introduced the ‘supplier alert page’, a system that allows consumers to prominently publicize poor quality service by vendors, in 2009. At first, it seemed the addition of this feature showed how responsive even a mega-company like Taobao could be in the face of growing consumer demands. But in November 2012, Taobao ceased to update the list, and in its stead Taobao shoppers created their own ‘Bad Suppliers’ thread on Alibaba.com

Vigilant consumers are driving the evolution of online retailers and the e-commerce regulatory landscape by sharing knowledge through social media, and showing little restraint when voicing criticisms. The new generation of online retailers will be those that listen and evolve.

Hints of Sophistication

According to the Ministry of Commerce, China will become the world’s largest online retail market in 2013, following years of rapid expansion. The nation had 194 million online shoppers and $123.72 billion in online retail trade at the end of 2011, marking a 53.7% rise year-on-year. Boston Consulting Group projects a threefold increase of the current e-commerce sales volume by 2015 to reach $360 billion.

Online consumers are not only growing in numbers, but are also growing in sophistication. Chinese consumers are often suspicious of official news sources and advertising, preferring instead to get retail wisdom from online reviewers and social networks, according to a McKinsey report released in April 2012.

Those who frequent social media sites do so regularly: 91% of the 5,700 respondents polled by McKinsey had used online social media in the last six months, compared to 67% in the US and 30% in Japan, and spend 46 minutes per day on social media sites, in contrast to 37 minutes in the US and seven minutes in Japan.

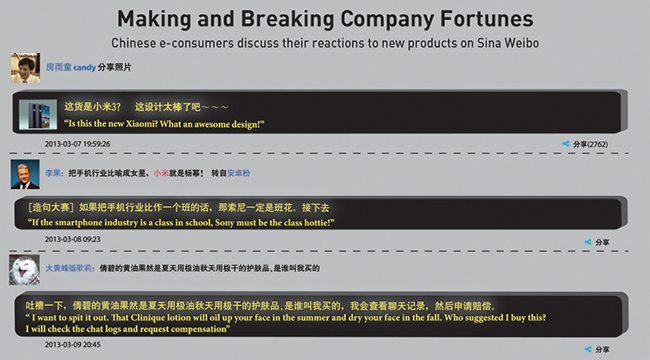

More than 40% of online consumers in China post product reviews on the web, double the percentage of online shoppers in the US, according to the Boston Consulting Group. An increasingly common channel for consumers to comment, or complain, about products they have bought is Sina Weibo—China’s Twitter-like site.

The result is a vast, comprehensive network of user comments on various types of goods online, which serves as an invaluable source of retail knowledge for the consumer. The reliance consumers place on objective online opinion is greater in China than anywhere else in the world, says the McKinsey survey.

The network of highly wired-in online buyers forms a de facto union of consumers, with the confidence to raise a racket if expectations are not met. The use of retailer complaint platforms among Chinese online consumers has also increased. Complaints submitted to the Consumer Protection Bureau more than doubled in 2011, to 90,000 from 36,000 in 2010.

Dissatisfied and Proud

Consumer vitriol for online retailers has garnered government attention and spurred changes in vendor behavior. Online price wars in August last year between 360buy.com, Suning Appliance and Gome Electrical Appliances Holdings, resulted in numerous searing customer complaints when shoppers found the sites were hiking prices before cutting to exaggerate the savings in their promotions.

The clamor was so loud that the Ministry of Commerce responded to charges of misrepresentation with Shen Danyang, the ministry’s spokesman, publicly stating that e-commerce companies should obey laws and regulations safeguarding fair competition. In September the National Development and Reform Commission launched an investigation into the price wars, and the Ministry of Commerce issued guidelines to regulate the conduct of over 40 e-commerce stores in China.

Suning responded to the 11th of November complaints this year by pledging not to engage in price wars in December when seasonal cuts are expected.

In a grander display, Chinese courts held Taobao liable for failing to suspend the account of a counterfeiter, also held liable, and charge a penalty in accordance with its rules. The ruling departs from previous judgments and shows the nation is taking steps to formalize an increasingly important portal of trade. While this case highlights IP rights as much as best consumer-driven practices, it stands to show that a platform as large as Taobao is not above scrutiny, and can suffer recourse when engaging in destructive e-retail practices.

Upping Their Game

Taobao, with its low price incentives, laid the foundation for many online Chinese to experiment with cyber-retail. “Taobao changed the way Chinese consumers thought about e-commerce. They got used to Taobao, and now are happy to go into other e-commerce sites,” says Ben Weldon, director of Thread Design, a company that assists Taobao retailers establilsh themselves on the Taobao platfrom.

Recent advances in online shopping technology have also brought more consumers to web-stores. “There were huge obstacles to selling online which have in the last 24 months, really crumbled and the floodgates have opened,” says Weldon.

Alipay, the world’s largest third-party online payment platform, enacted a system last year that allows consumers to first confirm they’re satisfied before releasing money to the vendor. The platform works with over 100 financial institutions, such as UnionPay and Visa, making it accessible to the vast majority of Chinese account holders.

Yihaodian.com, one of China’s largest online stores, reacted to customer complaints on the 11th of November in 2011 by guiding customer expectations downwards and reviewing delivery procedures this year.

“We lowered our promises. For example, in the past we promised next day delivery, but during those days we said we would deliver in two days or three days, we also added more resources, more staff to digest orders,” says Yu Gang, Co-founder and Chairman of Yihaodian. The company has also responded by creating a complaints system. A complaints manager provides daily reports on complaints received, and employees are rated and compensated on the basis of the customer feedback.

Survival of the Biggest

Traditionally, Chinese need a price incentive to go online and buy, whereas Western buyers are motivated by convenience. As Chinese consumers increasingly start looking to online retail for convenience, vendors will have to take this into account, which include delivery times. “If consumers are buying for convenience, then you want to ship within 24 hours,” says Jillian Xin, founder of online fashion retailer Xinlelu.com.

Other future shifts in online behavior include a more holistic approach to the consumer e-retail experience. For the platforms, this will mean adapting the design of their interface to keep up with changing tastes. “Users are beginning to appreciate a more stylized, minimalistic layout, something that’s not too messy,” says Xin. Chinese sites often have as many links as possible on their homepage but Xin believes that this is changing. Evidence of increasing aesthetic sophistication is apparent on the cleaner and more stylized look of Taobao and Vancl, whose homepages were initially more link-cluttered.

Tech advances, quickly adopted by the online Chinese consumer, are also ringing in web retail changes. Increasing smartphone use will spur vendors to adapt their home pages to be handset friendly. A third of urban residents in China currently use smartphones and the numbers are rising. “You’ll see a major share of your transactions coming from a smartphone in the future,” says Xin. In the US more than 50% of online orders are done through mobile devices, and Chinese are trending that way, said Patrick Deloy from e-commerce consultant Bluecomgroup. Continued price sensitivity will fuel consolidation in the industry, favoring mega-sites few in number. Size will be everything in certain sectors. “It’s going to be just a size game, the bigger you are, the more likely you are to survive in this, because scale is a powerful thing in China. So many of these websites compete on price, the bigger the scale you have, the larger the bargaining power you have with your suppliers, the more you can drive costs down and win this game. Also, these bigger players can work on economies of scale with their logistics and their backend operations,” says Xin.

The epoch of consolidation is already underway as vendors increasingly overlap with each other. Dang Dang originally sold only books, but now sells multimedia and other IT items, encroaching into the market of electronics retailers. Vancl and Mombasa both started as fashion websites, but now sell accessories as well. As websites start to offer largely similar goods, the ones that falter in the price wars will fall away, leaving the strongest standing.

As consumers become increasingly experienced web-shoppers, they will move to purchase goods they wouldn’t traditionally purchase online. “People are exploring new categories like food and fresh fruit,” says Xin.

The post-mortem of Singles Day has most importantly led to an awareness among retailers that the e-consumer cannot be taken for a ride. Vendors now know that attracting consumers will mean a principled approach to retail and better discipline when it comes to quality control. Chinese consumers will be watching closely during the next celebration of bachelorhood, harboring hopes that there will be less retail heartache and thwarted shopping dreams. And if there are. They will complain.